[Asia Economy Reporter Lee Seon-ae] KB Securities has maintained its investment opinion of 'Buy' and a target price of 230,000 KRW for Samsung Electro-Mechanics.

According to KB Securities on the 26th, Samsung Electro-Mechanics' Q3 revenue and operating profit are estimated at 2.58 trillion KRW (+12.6% YoY, +4.1% QoQ) and 412.3 billion KRW (+36.3% YoY, +21.5% QoQ, OPM 16.0%), respectively, expected to meet consensus operating profit. The significant margin improvement compared to the previous quarter is expected to be driven by the substrate division. The selling price increase of FC CSP and FC BGA is anticipated, leading to an operating profit margin forecast of 13% for the substrate division (Q2 was 6.9%). The component division's revenue is expected to be 1.29 trillion KRW, with performance growth supported by an increase in average selling price due to product mix improvement. Although there was some production disruption caused by a power outage at the Tianjin plant, which accounts for more than 40% of MLCC production capacity, the scale was limited, and the impact on performance is minimal, so it was not reflected in the earnings estimates. However, the risk related to power supply has not been completely resolved.

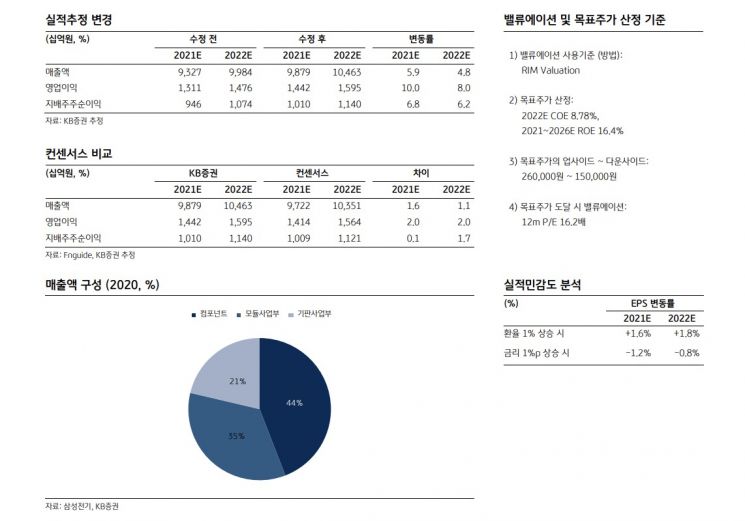

Hwang Go-woon, a researcher at KB Securities, explained, "Reflecting the rise in substrate ASP, we raised the substrate division's 2021 and 2022 revenues by 11.2% and 13.1%, respectively, and accordingly adjusted the company's 2021 and 2022 net income attributable to controlling shareholders upward by 6.8% and 6.2%, respectively."

Due to concerns over a decline in Chinese smartphone shipments and peak-out in IT sets such as PCs, Samsung Electro-Mechanics' stock price has shown a sluggish trend over the past six months. However, unlike the 2017?2018 cycle, the new upward cycle is expected to be prolonged due to diversification of demand and reduced volatility in set demand. In 2022, major customers are expected to expand high-end smartphone volumes, and new demand from servers and automotive electronics is projected to drive strong performance next year as well. The operation of the new Tianjin plant is expected to lead MLCC volume growth until 2024, and substrate demand due to PC replacement demand next year is also expected to remain solid.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)