Net Income Increased and Subordinated Bond Issuance Rose

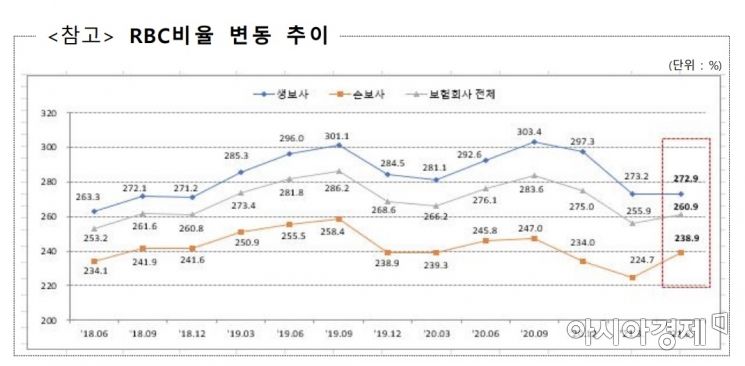

Insurers' Risk-Based Capital (RBC) Ratio (As of the end of June 2021. Source: Financial Supervisory Service)

Insurers' Risk-Based Capital (RBC) Ratio (As of the end of June 2021. Source: Financial Supervisory Service)

[Asia Economy Reporter Oh Hyung-gil] The first half of the year brought some relief to insurers in managing their soundness.

Not only did they benefit from the performance improvement due to the COVID-19 tailwind, but the ongoing capital expansion efforts in preparation for the implementation of the new International Financial Reporting Standard (IFRS17) and the new solvency regime (K-ICS) in 2023 have been a great help.

According to the "Status of Insurance Companies' Risk-Based Capital (RBC) Ratios as of the End of June 2021" released by the Financial Supervisory Service, the average RBC ratio of all 53 insurers as of the end of June this year was 260.9%, up 5 percentage points from 255.9% in the previous quarter.

The RBC ratio, an indicator measuring the financial soundness of insurers, is calculated by dividing the amount of available capital that can cover losses from various risks by the required capital, which is the amount of loss expected if those risks materialize. It shows whether insurers have sufficient funds to pay insurance claims if various potential risks occur.

The Insurance Business Act mandates maintaining this ratio above 100%.

By sector, life insurers recorded an RBC ratio of 272.9%, down 0.3 percentage points, while non-life insurers rose 14.2 percentage points to 238.9%.

Available capital increased by 4 trillion KRW to 167.4 trillion KRW compared to the end of March. Insurers posted a net profit of 1.8 trillion KRW, and capital increased through subordinated bond issuance (1.9 trillion KRW) and paid-in capital increase (0.5 trillion KRW).

During the same period, required capital rose by 0.4 trillion KRW compared to the end of March due to an increase in insurance risk (0.4 trillion KRW) and credit risk from increased operating assets (0.5 trillion KRW). On the other hand, other risk amounts decreased by 0.5 trillion KRW due to institutional improvements.

By sector, the RBC ratio of life insurers as of the end of June was 272.9%, down 0.3 percentage points. The RBC ratio of non-life insurers rose 14.2 percentage points to 238.9%.

Capital Expansion Surpasses 3 Trillion KRW This Year

Among major non-life insurers, Samsung Fire & Marine Insurance saw a 35.8 percentage point increase to 322.4%, Hyundai Marine & Fire Insurance reached 196.9%, DB Insurance 211.2%, and KB Insurance 178.7%, rising 19.3, 16.0, and 15.4 percentage points respectively.

Major insurers have been focusing on capital expansion through subordinated bond issuance for several years. This year, the scale of capital expansion by insurers is expected to exceed 3 trillion KRW, with subordinated bonds alone already surpassing 2 trillion KRW.

DB Insurance issued subordinated bonds worth 0.5 trillion KRW, while KB Insurance (379 billion KRW), Hyundai Marine & Fire Insurance (350 billion KRW), Mirae Asset Life Insurance (300 billion KRW), and Meritz Fire & Marine Insurance (210 billion KRW) also issued bonds.

Fubon Hyundai completed a paid-in capital increase of 458 billion KRW targeting its largest shareholder, Fubon Life Insurance, and Carrot General Insurance also carried out a paid-in capital increase of 100 billion KRW. KB Life Insurance issued subordinated bonds of 130 billion KRW in May and 70 billion KRW in August, and Kyobo Life Insurance recently completed the issuance of 470 billion KRW in hybrid capital securities.

An industry insider said, "In preparation for the implementation of IFRS17, the trend of capital expansion has continued for several years to proactively improve financial soundness. With risks inside and outside the industry changing due to the resurgence of COVID-19 and additional interest rate hikes expected within the year, managing soundness will become even more important going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)