Demand for Inventory, Orders, and Sales Data to Solve Semiconductor Supply Chain Issues

Voluntary Survey Conducted Amid Pressure Referencing Defense Materials Protection Act

Semiconductor Industry Bewildered by Sensitive Data Requests... Samsung and Others' Reactions Awaited

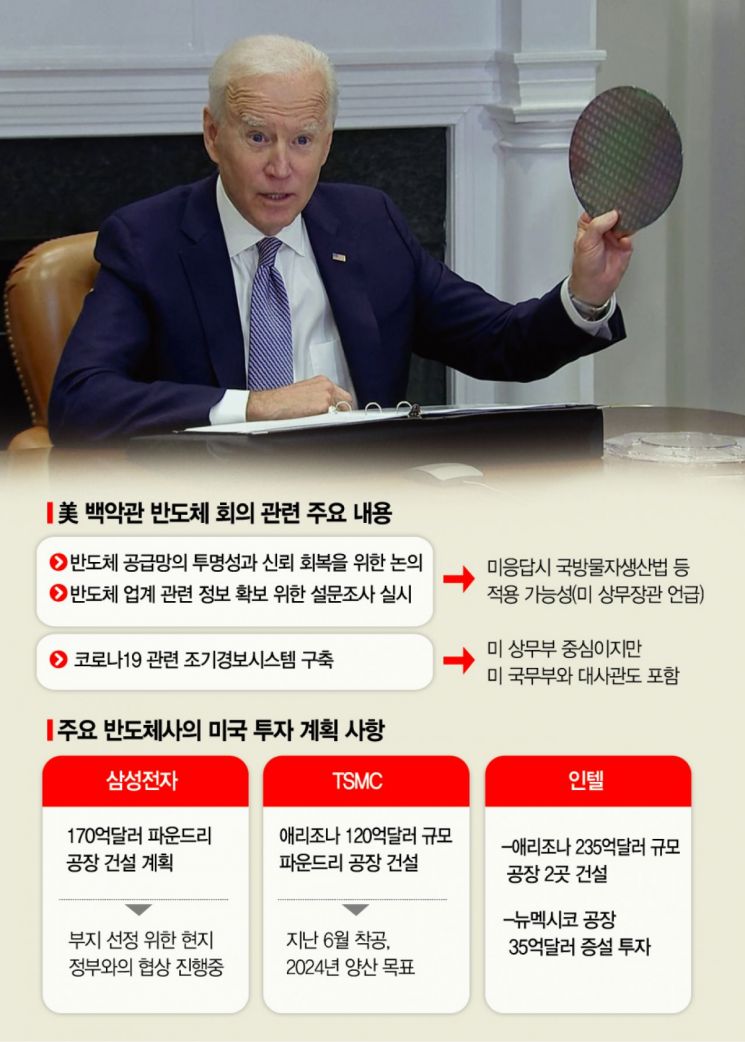

The U.S. administration under Joe Biden has pressured semiconductor companies such as Samsung Electronics and TSMC to disclose sensitive information including production volumes and inventory levels, citing semiconductor supply shortages. The goal is to establish a semiconductor supply chain centered around the United States. While the administration stated that the provision of corporate information would be voluntary, it also made clear that the Defense Production Act (DPA) could be applied, putting the semiconductor industry, which was planning to expand its business locally, in a difficult position.

On the 23rd (local time), the White House held a virtual meeting with the semiconductor industry, led by Brian Deese, Chair of the National Economic Council (NEC), and Gina Raimondo, Secretary of Commerce. This was the third meeting convened by the Biden administration regarding the semiconductor shortage crisis. During the meeting, the U.S. government and semiconductor companies discussed global semiconductor supply issues and production disruptions caused by the COVID-19 Delta variant. Attendees reportedly included Samsung Electronics, Taiwan's TSMC, Intel, Apple, Microsoft (MS), General Motors (GM), Ford, Daimler, and BMW.

White House: "Disclose Corporate Information"

The White House emphasized the need to improve transparency and trust within the semiconductor supply chain during the meeting. Specific demands can be inferred from a blog post released by the White House on the same day titled "Measures to Prevent and Resolve Semiconductor Supply Chain Disruptions." The White House stated in the post, "We are conducting a voluntary survey of industry participants to receive corporate information that will help diagnose problems in the semiconductor supply chain and create production processes to respond to the semiconductor shortage." According to foreign media, the survey includes information related to semiconductor companies' inventory, orders, and sales, and the questionnaire must be submitted within 45 days.

The White House also announced cooperation with Southeast Asian governments and others to resolve global supply chain issues related to COVID-19, stating that an early warning system for shutdowns caused by COVID-19 is being established. While led by the U.S. Department of Commerce, the system also includes the U.S. Department of State and U.S. embassies worldwide, aiming to detect supply chain problems early, find solutions, and collaborate with trade partners and the private sector.

This policy by the White House is interpreted as a determination to effectively reorganize global semiconductor dominance centered on the United States, citing supply chain issues. The U.S. share of global semiconductor production capacity has fallen from 37% in 1990 to 12% last year. White House spokesperson Jen Psaki said, "Since President Biden took office, semiconductor shortages have been a top priority," adding, "(Companies) need to provide transparency to minimize the impact on American workers and consumers."

"What Should We Do?"... Samsung Faces a Dilemma

Samsung Electronics and the semiconductor industry are in a difficult position due to the White House's measures. Although the White House described the early warning system as "designed to protect proprietary and business-sensitive information," submitting detailed sensitive information such as inventory status to the U.S. government is unwelcome for companies amid fierce competition in the global semiconductor market. Bloomberg reported that Gina Raimondo's team at the U.S. Department of Commerce has been discussing this with companies for months, but most companies refused to submit corporate information to the government in previous meetings.

In response, Secretary Raimondo emphasized that submitting information is "voluntary," but also said, "We do not want to enforce it forcibly. However, if they do not comply, there is no choice," referring to the application of the DPA. This is effectively a warning to semiconductor companies operating in the U.S.

Samsung Electronics, a leading domestic semiconductor company, is expected to face increased concerns over the Biden administration's demand for information disclosure. Not only is providing corporate information burdensome, but this demand also acts as pressure amid Samsung's recent announcement in May to expand investment in the U.S. and ongoing site evaluations. The U.S. government mentioned that legislation supporting the semiconductor industry is currently being discussed in Congress, revealing a link between cooperation in reorganizing the semiconductor supply chain centered on the U.S. and investment. Considering tax incentives from local governments, Samsung Electronics is likely to view this central government demand as a risk. Attention is also focused on the responses of TSMC, Intel, and others who have announced large-scale investments in the U.S.

On the other hand, some U.S. semiconductor companies have expressed positive evaluations. Tom Caulfield, CEO of U.S. semiconductor company GlobalFoundries, said in a statement after the meeting, "I want to applaud Secretary Raimondo's short- and long-term plans to resolve the semiconductor shortage."

A domestic semiconductor industry official said, "Inventory and production volumes are very sensitive information in the semiconductor industry, so companies have not disclosed them until now, and revealing them could affect market dynamics," adding, "The fact that information from major domestic semiconductor companies such as Samsung Electronics and SK Hynix is leaking to the U.S. could itself be problematic."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.