[Asia Economy Reporter Lee Seon-ae] Domestic major platforms Kakao and Naver (NAVER) have been falling together day after day due to regulatory risks. Amid the severe downward trend, opinions in the securities industry are divided on their future, drawing attention to the outcome. The general outlook is more favorable for Naver than for Kakao. It is widely analyzed that Naver is relatively freer from regulatory risks and will not suffer severe damage (stock price decline).

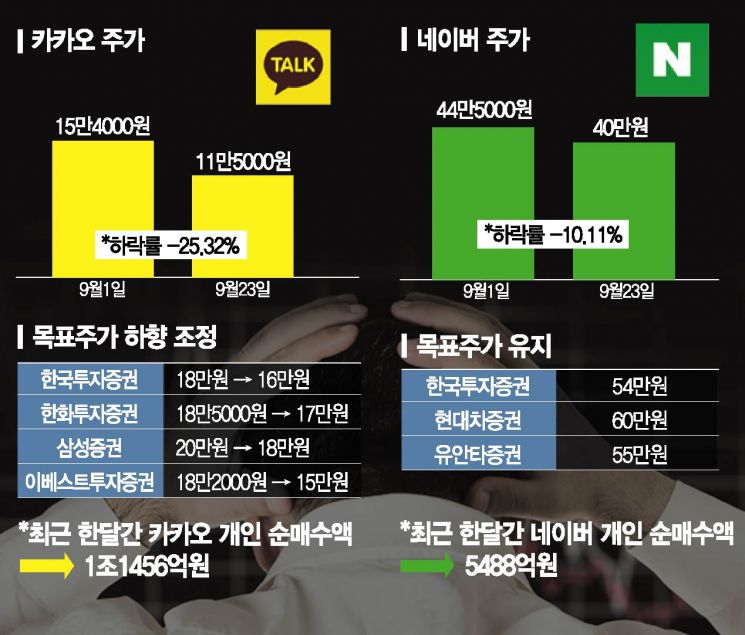

According to the Korea Exchange on the 24th, Kakao's stock price, hit directly by the financial authorities' 'platform regulation,' has been showing a weak trend day after day, pushing it to the brink of losing its 6th place in market capitalization. On the previous day, Kakao's stock price closed at 115,000 won, down 4,500 won (3.77%) from the previous trading day. The stock price has been falling on every trading day except for one since the 6th of this month. The decline rate this month reaches 25.3%. The market capitalization, which once rose to 3rd place in the KOSPI market in June, has shrunk to 51.1741 trillion won. Compared to the end of August (around 69 trillion won), it is as if 1 trillion won has evaporated every trading day.

The securities industry sees volatility in Kakao's stock price as inevitable for the time being. It is still difficult to conclude that the stock price has bottomed out, so they remain silent about the 'buying opportunity at a low price.'

Jung Ho-yoon, a researcher at Korea Investment & Securities, said, "This regulatory issue is an unavoidable problem in the growth process of platforms, and it is necessary to observe to what extent the revenue models, such as mobility and fintech, which are the issues, will be adjusted," adding, "Regulatory noise is unlikely to end soon and will weigh down at least until October, when the National Assembly audit schedule ends."

Lee Chang-young, a researcher at Yuanta Securities, said, "Kakao's active expansion into relatively diverse businesses such as finance and taxis based on the platform has become a bigger risk this time due to the monopoly regulation that had been focused on Naver," and predicted, "It is expected that stricter 'principles' will be applied, demanding the termination of Kakao Pay's financial intermediary services, so an unfavorable regulatory environment for Kakao will continue for some time."

Target prices for Kakao are also being lowered. On the 16th, Samsung Securities and Hanwha Investment & Securities lowered Kakao's target price by 10% and 8.1%, respectively. On the 17th, Korea Investment & Securities also lowered it by 12.5%, from 180,000 won to 160,000 won. Ebest Investment & Securities lowered it by about 17.6%, from 182,000 won to 150,000 won on the same day. It is the first time in one year and five months since April last year that domestic securities firms have lowered Kakao's target price.

Although sharing their fate as major platforms, Naver's situation is somewhat better. On the previous day, Naver's stock price closed at 400,000 won, down 3,000 won (0.74%) from the previous trading day. Compared to 445,000 won on the 1st, the stock price decline rate this month is 10.1%. Although the decline rate is in the 10% range, it is a better situation compared to Kakao.

This is interpreted as Naver being freer from regulatory risks. Kim Hyun-yong, a researcher at Hyundai Motor Securities, said, "The impact on Naver's fintech sales due to this financial regulation will be less than 5%, so the effect will be very limited," and judged, "The neighborhood market issue mentioned as an additional regulatory concern has low relevance to Naver's business structure."

Many opinions say now is a buying opportunity, and there is no target price downgrade. Lee Moon-jong, a researcher at Shinhan Financial Investment, explained, "Naver is relatively comfortable regarding regulatory concerns," and "I consider this stock price decline a buying opportunity." Researcher Jung emphasized, "There are only two parts in Naver's business divisions where value may change due to regulation: commerce and fintech," adding, "Even applying a conservative perspective, (the current stock price) has entered an undervalued area."

Contrary to the securities industry's judgment, individual investors have bought more of the heavily fallen Kakao. Individual investors, confident early on that the stock price had bottomed out, concentrated their purchases on Kakao, with net purchases exceeding 1 trillion won (1.1456 trillion won) in the past month. During the same period, Naver's net purchases amounted to 548.8 billion won. Although regulation is expected to act as a negative factor, many forecasts say long-term growth potential remains valid.

Researcher Jung said, "It is true that regulatory-related uncertainties have expanded in the short term, but the long-term growth story of internet companies has not been damaged." Samsung Securities researcher Oh Dong-hwan diagnosed, "The expansion of platform business models in mobility, fintech, and content areas is a global trend, not just domestic," and added, "Although platform regulations are being strengthened overseas due to opposition from existing businesses arising from the innovation process, the paradigm shift in the industry is a trend of the times."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.