[Asia Economy Reporter Kang Nahum] Naver Smart Store is advancing the settlement standard to the 'day after collection completion,' increasing business stability and satisfaction among sellers.

According to Naver on the 24th, the 'Smart Store Fast Settlement' is a settlement system that utilizes a ‘Fraud Detection System’ based on big data to identify risky transactions and sellers.

Naver shortened the settlement cycle from two days after delivery completion to one day in January. In April, the payment ratio was expanded from 90% to 100%, and starting this December, the settlement standard will be further advanced to the ‘day after collection completion.’

Collection completion means that the product has been handed over from the seller to the courier company and is ready to start delivery, effectively marking the start of the delivery process. Leveraging its technology, Naver is shortening the settlement cycle and relaxing seller application requirements as part of its 'Fast Settlement Innovation.'

Online businesses incur various costs such as purchase payments, labor costs, and rent between product orders and sales settlement, making working capital for cash flow the biggest concern. According to the ‘2020 Causes of Deterioration in SME Financing’ announced by the Korea Federation of SMEs, 12.7% cited ‘delayed collection of sales proceeds’ as a cause, and many sought high-interest loan products to maintain smooth store operations.

In particular, Coupang, which emphasizes 'bullet delivery' and prioritizes consumer convenience, faced controversy among sellers over 'delayed settlements.' Sellers expressed dissatisfaction with a system where the settlement cycle could take up to 60 days, forcing them to reluctantly pay a 4.8% annual fee to use the 'advance settlement service.'

Industry experts analyze that Coupang’s settlement method, which extends the settlement cycle as long as possible rather than immediately paying cash from sales, aimed to create an effect of improved cash flow combined with increased sales. In fact, Coupang, which was listed on the U.S. stock market this year, recorded an operating cash flow of about 351.5 billion KRW last year, recovering from negative for the first time in six years since 2014, which was used as an indicator of Coupang’s business stability.

In response to these seller complaints, the Fair Trade Commission also proposed a revision to the ‘Delayed Interest Rate Notification for Delayed Payment of Product Sales Proceeds.’ Starting from the 21st of next month, large-scale retailers who pay after more than 60 days from direct purchase of goods will be required to pay delayed interest at an annual rate of 15.5%, a law widely seen as targeting Coupang, which mainly conducts direct purchase transactions.

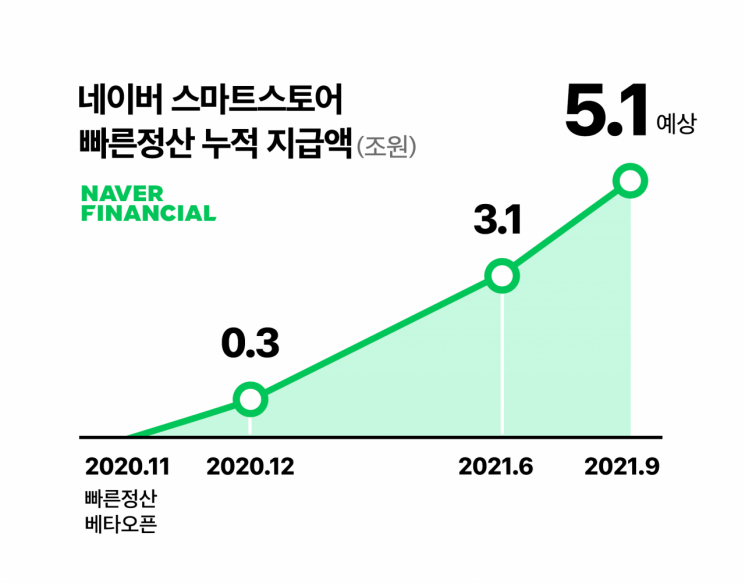

On the other hand, Naver’s ‘Fast Settlement’ allows sellers to receive 100% of the settlement amount about 4.4 days after payment completion, and from December, about 3.3 days, earning high praise from small business owners challenging entrepreneurship. Since November last year, the cumulative amount settled through fast settlement has reached about 4.5 trillion KRW, and it is expected to reach 5 trillion KRW by the end of September.

A Naver Smart Store seller said, "Fast settlement is an excellent system for businesses without extra funds in terms of cash flow, and I actively recommend Smart Store to people around me considering online startups." He added, "I sell items that require costs such as product purchasing and production, so it is very convenient for securing cash flow and greatly helps business expansion."

Additionally, Naver supports order management service fees free of charge for one year to stabilize early-stage Smart Store sellers’ businesses, and offers sales-linked fee support for six months to sellers who want exposure in Naver Shopping search.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)