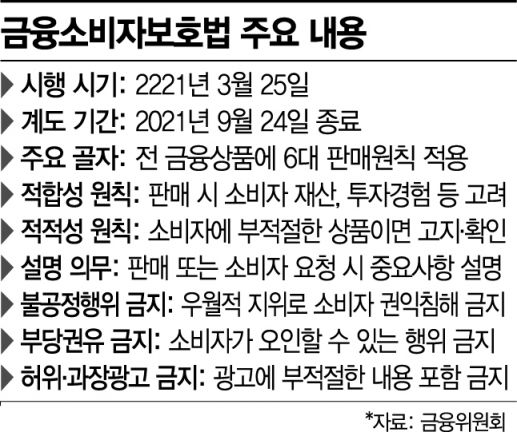

[Asia Economy Reporter Kwangho Lee] The six-month grace period for the Financial Consumer Protection Act and the Act on Reporting and Using Specified Financial Transaction Information, which had been temporarily applied since March, will end on the 24th. Financial authorities have announced that the laws will be applied without exceptions, raising concerns about potential damages to both financial companies and consumers.

According to financial authorities, the guidance period for the Financial Consumer Protection Act and the grace period for virtual asset service providers' registration will end on this day, and from the 25th, financial services must be reorganized or suspended in accordance with the revised laws.

The entities most directly impacted by the enforcement of the Financial Consumer Protection Act are big tech and fintech operators running financial platforms such as KakaoPay, Naver Financial, and Toss. If they do not reorganize their product recommendation and comparison services to comply with the Act, they must suspend these services starting on the 25th. The service reorganization on online platforms is designed to allow consumers to clearly distinguish the sellers of financial products. Instead of concluding contracts directly on the platform, the process will change so that consumers are redirected to the respective financial institution’s website to complete the contract.

Some platforms will also eliminate the product recommendation function. The Financial Services Commission recently concluded that these services on financial platforms constitute 'intermediation' rather than 'advertising agency' activities and demanded that platforms register as intermediaries or suspend the services by the 24th. Financial platform companies are under intense pressure due to this authoritative interpretation by financial authorities.

Previously, KakaoPay suspended its peer-to-peer (P2P) investment service and car insurance comparison service. Toss also decided to completely reorganize its credit card comparison service. The fintech industry requested an extension of the grace period for the Financial Consumer Protection Act, but financial authorities rejected the request, stating "no exceptions."

Banks are also actively working to avoid becoming the 'first violator' of the Financial Consumer Protection Act. Commercial and regional banks have completed preparing investment product brochures reflecting the Act’s requirements and plan to implement them starting on the 27th. Some banks have determined that partial supplementation of the investor suitability assessment system is necessary and plan to complete these improvements by the end of the year.

A bank official said, "We have made thorough preparations, including staff training and AI simulations, with the mindset that we must not become the first violator of the Financial Consumer Protection Act."

The deadline for virtual currency exchanges to register under the Act on Reporting and Using Specified Financial Transaction Information also ends on this day. Accordingly, exchanges that have not registered with the Financial Intelligence Unit (FIU) by the 25th must close.

Among the 63 domestic virtual currency exchanges, only 29 have obtained the mandatory Information Security Management System (ISMS) certification. The 34 exchanges without certification will not be able to operate from the 25th.

Among those certified, only five exchanges ? Upbit, Bithumb, Coinone, Korbit, and Flybit ? have submitted their virtual asset service provider registration to the FIU. Of these, Upbit is the only one whose registration has been approved, and only Upbit, Bithumb, Coinone, and Korbit have partnered with banks to provide real-name accounts enabling Korean won deposits and withdrawals.

Even if an exchange has ISMS certification, the 25 exchanges that have not partnered with banks for real-name accounts must suspend their Korean won market, where coins are bought and sold with Korean won, and can only operate coin markets where coin-to-coin trading is possible.

As the closure of exchanges becomes a reality, damage to virtual currency investors is inevitable. According to the office of National Assembly member Kang Min-guk of the People Power Party, an analysis of 22 large and small exchanges showed that, excluding the four exchanges with Korean won markets (Upbit, Bithumb, Coinone, Korbit), the amount deposited in the other 18 exchanges totaled 2.3496 trillion won, with 2.21 million subscribers.

Financial authorities expect that most ISMS-certified exchanges will submit reports for operating coin markets, so they anticipate that investor damage will not be significant. However, for exchanges that have lost Korean won trading capabilities, there is a high possibility of customer attrition, making additional closures and related investor damages unavoidable.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.