Kyobo Avoids Severe Disciplinary Action

Controversy Over Sanctions on Samsung and Hanwha Continues

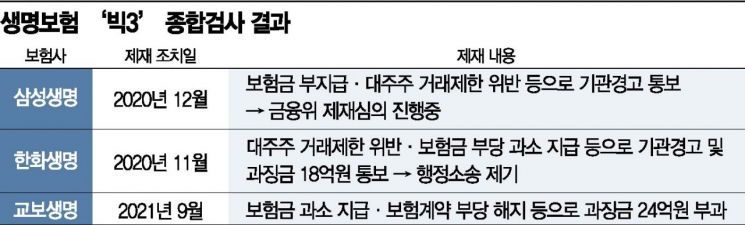

[Asia Economy Reporter Oh Hyung-gil] As the sanctions against Kyobo Life Insurance were recently disclosed, the fortunes of the ‘Big 3’ life insurance companies under comprehensive inspection have diverged. Kyobo Life Insurance was able to avoid severe penalties by receiving a fine, but Samsung Life Insurance and Hanwha Life Insurance, which were notified of severe sanctions, have yet to complete their sanctions, creating uncertainty in management.

According to the Financial Supervisory Service and the insurance industry on the 23rd, Kyobo Life Insurance was sanctioned with a fine of 2.422 billion KRW and other penalties due to underpayment of insurance benefits and unfair contract switching, following the comprehensive inspection conducted last year.

Kyobo Life Insurance sold whole life insurance products with an annuity conversion rider from June 2001 to December 2002. After October 2007, annuity conversions were applied and survival annuities were paid.

However, from December 2015 to November 2020, Kyobo Life Insurance violated the Insurance Business Act by not applying the minimum guaranteed interest rate of 3.0% stipulated in the policy to annuity conversion contracts, and by calculating using different standards for the announced interest rate and individual pension mortality rate, resulting in underpayment of insurance benefits.

Unfair insurance switching and improper contract cancellations were also detected. Kyobo Life Insurance operated its IT system to exclude existing insurance contracts from comparative guidance, leading policyholders to apply for new insurance contracts with coverage similar to existing ones and causing the old contracts to lapse.

Contracts that could not be canceled due to violation of the obligation to notify before the contract, because no insurance claim event occurred within two years from the coverage start date, were arbitrarily canceled and sanctioned.

It was confirmed that executive incentive payments were made annually by approval without going through the remuneration committee resolution process.

Regarding executive compensation, the remuneration committee must deliberate and resolve matters related to compensation decisions and payment methods, but Kyobo Life Insurance was found to have paid compensation by approval without committee deliberation and resolution four times annually from July 2017 to August 2020.

However, since most of the pointed issues were based on violations of the Insurance Business Act, the insurance industry evaluates Kyobo Life Insurance’s sanctions as the only one among the Big 3 life insurers to avoid severe penalties.

On the other hand, Samsung Life Insurance and Hanwha Life Insurance, which previously received the severe sanction of ‘institutional warning,’ continue to face controversy over the comprehensive inspection results.

The Financial Services Commission has been unable to reach a conclusion on Samsung Life Insurance’s sanctions for over nine months. The Financial Supervisory Service conducted a comprehensive inspection of Samsung Life Insurance in 2019 and the Sanctions Review Committee decided on an institutional warning, a severe penalty, in December last year.

The Financial Services Commission explains that the delay is inevitable as it is reviewing seven contentious issues including non-payment of cancer insurance benefits for hospitalization in convalescent hospitals, violations of major shareholder transaction restrictions, and underpayment of insurance benefits. There are also expectations that the final decision will not be made within this year. The delay in the Financial Services Commission’s resolution is causing side effects such as postponement of entry into new businesses like MyData (personal credit information management business).

Hanwha Life Insurance has had the severe sanction confirmed by the Financial Services Commission but has filed an administrative lawsuit in protest. Due to the severe sanction, Hanwha Life Insurance has been unable to enter new businesses requiring financial authorities’ approval for one year, which led to the cancellation of the sale of Carrot General Insurance between Hanwha’s subsidiaries Hanwha General Insurance and Hanwha Asset Management.

An industry insider said, "The aftermath of the comprehensive inspection, revived under the consumer protection policy during former Financial Supervisory Service Chairman Yoon Seok-heon’s tenure, is not easily resolved," adding, "The financial authorities also feel considerable pressure regarding sanctions, as courts have recently issued rulings canceling sanctions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)