[Asia Economy Reporter Park Jihwan] Despite various measures by financial authorities to promote individual short selling transactions, the proportion of individuals in total short selling remains minimal, while the share of foreigners has further increased.

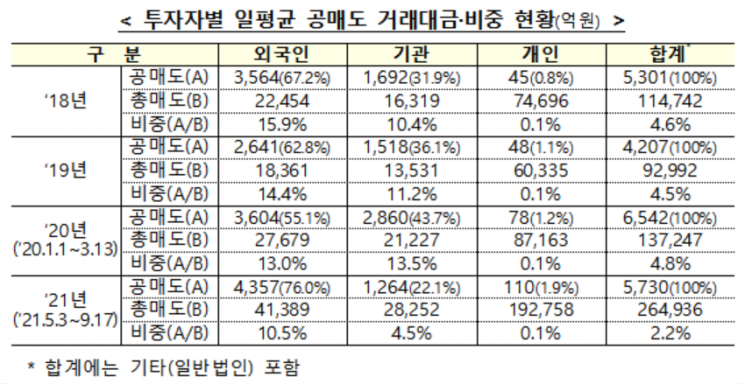

On the 23rd, the Financial Services Commission announced that the average daily short selling transaction amount during the partial resumption of short selling (May 3 to September 17) was 573 billion KRW. Among this, the average daily short selling transaction amount by foreigners was 435.7 billion KRW, accounting for 76.0% of the total short selling amount. This is a sharp increase compared to 62.8% in 2019 and 55.1% from January to March last year. A Financial Services Commission official stated, "The average daily short selling amount by foreigners increased by about 21% compared to the previous year, but the proportion of short selling to foreigners' total transaction amount decreased from 13% in January to March last year to 10.5% from May to September this year."

On the other hand, the average daily short selling transaction amount by individual investors was only 11 billion KRW. Although it increased by about 41% compared to January to March last year due to the expansion of individual lending, it remained minimal compared to the overall scale. However, during the same period, the proportion of individual investors' short selling amount in total short selling increased from 1.2% to 1.9%.

The average daily short selling transaction amount by institutions was 126.4 billion KRW, a 55.8% decrease compared to 286 billion KRW from January to March 2020 before the short selling ban. It is analyzed that the average daily short selling amount by institutions decreased by more than half due to measures such as the ban on short selling by market makers implemented in April.

The Financial Services Commission stated that no significant relationship was found between short selling amounts and stock prices during the analysis period. Although there were concerns that stock prices would fall due to the resumption of short selling, the impact of short selling on stock prices was not confirmed. The Commission said, "No significant relationship was found between the short selling ratio (short selling amount/total selling amount) and stock price performance (rate of change) based on the entire market," adding, "For individual investors as well, there was no regular relationship between the short selling ratio and stock price fluctuations, similar to the overall market pattern."

The financial authorities plan to continue various institutional improvements to minimize the inconvenience of individual investors in short selling investments. The Financial Services Commission plans to expand the individual lending service currently provided by 19 companies to all 28 securities firms handling margin loans within this year. Additionally, from November this year, the individual lending borrowing period will be extended from the current 60 days to over 90 days, and additional maturity extensions will be possible upon maturity.

A Financial Services Commission official stated, "We plan to build a real-time integrated lending transaction system for Korea Securities Finance within this year to utilize lending resources more efficiently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)