Steps Toward Abandoning Won Market... Gopax Awaits Real-Name Account Contract

Only Cryptocurrency Trading Allowed on Exchanges with ISMS Certification

Concerns Over Investor Impact Due to Many Kimchi Coins

[Asia Economy Reporter Gong Byung-sun] The deadline for domestic cryptocurrency exchanges to register is just one day away. Investors trading on exchanges that have not obtained real-name accounts are inevitably facing losses.

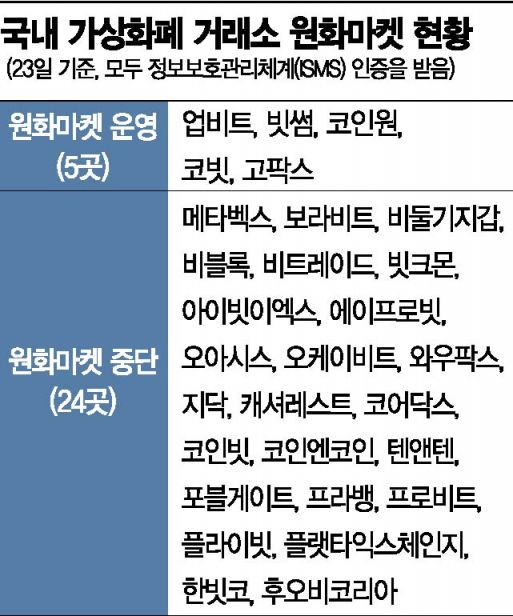

According to the industry on the 23rd, domestic cryptocurrency exchanges must complete registration with the Financial Intelligence Unit (FIU) by the 24th. To proceed with the registration process, requirements such as obtaining a real-name account and Information Security Management System (ISMS) certification are necessary. So far, four exchanges?Upbit, Bithumb, Coinone, and Korbit?have obtained real-name accounts, and a total of 29 exchanges, including these four, have received ISMS certification.

Investors of the 25 exchanges that have only obtained ISMS certification must purchase cryptocurrencies before investing. Among them, Flybit, the only exchange that has submitted registration to the FIU, suspended its Korean won market operations on the 17th and opened a Tether (USDT) market. To trade cryptocurrencies on Flybit, users must first purchase Tether coins and then use them like cash. Other exchanges are also abandoning the Korean won market while opening Bitcoin and Ethereum markets. However, Gopax is still operating its Korean won market as it awaits a real-name account contract with a commercial bank.

Due to the nature of coin markets, investors must purchase cryptocurrencies with Korean won before participating in the market, which inevitably causes inconvenience. When quick action is required, investors must go through the step of purchasing cryptocurrencies. Additionally, if the overall cryptocurrency market crashes, investors’ losses can be compounded.

In particular, so-called Kimchi coins, which are not supported for trading on other exchanges, are expected to suffer greater damage. Trading volume depends on the situation of the respective exchange, and unlike widely used cryptocurrencies such as Bitcoin and Ethereum, these coins cannot be transferred to other exchanges for trading. The Financial Services Commission has recommended that when closing the Korean won market to transition to coin markets, exchanges should support Korean won withdrawals for at least 30 days. This means investors should cash out cryptocurrencies that cannot be transferred in advance. However, even if investors try to cash out, trading itself is not happening, making selling difficult.

Professor Hong Ki-hoon of Hongik University’s Business Administration Department explained, "Nevertheless, for cryptocurrencies that are not traded on other exchanges, cashing out as soon as possible is a way to reduce losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)