Foreigners Net Bought 803.8 Billion Last Week

Up Over 6% From August Low

External Uncertainties Still a Concern

Q3 Earnings Support Stock Price Rally

[Asia Economy Reporter Song Hwajeong] Samsung Electronics recently succeeded in rebounding, supported by foreign buying, drawing attention to whether this upward trend will continue. Despite variables such as concerns over China's Evergrande Group and the U.S. tapering (asset purchase reduction) issue, which make the stock market outlook less positive, earnings are expected to be solid, likely helping to support the stock price.

As of 9:50 a.m. on the 23rd, Samsung Electronics was trading at 77,100 KRW, down 100 KRW (0.13%) from the previous day. The stock showed slight gains initially but turned weak, fluctuating within a narrow range. The market, which resumed after the holiday, started weak due to concerns over Evergrande Group, seemingly affecting the stock price.

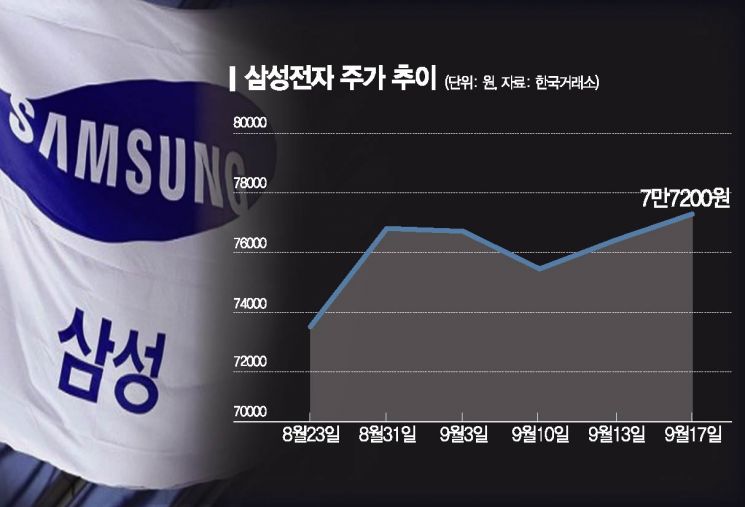

Samsung Electronics' stock price rebounded recently as foreign buying inflows increased. Last week, Samsung Electronics rose 2.25%, outperforming the KOSPI's 0.47% increase during the same period. Compared to the yearly low of 72,700 KRW recorded on August 20, the stock has risen more than 6%. Foreign investors drove the stock price up, having net purchased Samsung Electronics for five consecutive days. Last week, foreign investors net bought 803.8 billion KRW worth of Samsung Electronics, making it the most purchased stock. Considering that foreign investors net bought 813.5 billion KRW in the KOSPI last week, buying was concentrated on Samsung Electronics.

Although the rebound was successful, the stock market outlook is not bright due to increased external uncertainties, so it remains to be seen whether the smooth upward trend will continue. During the holiday, concerns about the potential bankruptcy of China's Evergrande Group and fears of interest rate hikes by the U.S. Federal Open Market Committee (FOMC) were expected to impact the market. While these concerns have eased, calming the short-term sharp decline in global stock markets, caution is expected to persist.

Kim Byung-yeon, a researcher at NH Investment & Securities, said, "China's Evergrande Group has announced emergency interest payments due through creditor negotiations and asset sales, seemingly putting out the immediate fire, and the September FOMC announcement was not significantly different from expectations, calming the short-term sharp decline in global stock markets." He added, "However, considering the scheduled tapering and uncertainties about China's long-term policy stance, the decoupling between developed and emerging markets is expected to continue." Kim also noted, "Due to capital outflows avoiding major shareholder requirements and the slowdown in index momentum caused by the global economic slowdown, Korea is expected to maintain a limited box range in the fourth quarter."

Despite ongoing uncertainties, some analyses suggest that since the KOSPI is undervalued and fundamentals remain solid, increasing exposure to semiconductors and related sectors is advantageous. Lee Kyung-min, a researcher at Daishin Securities, said, "The fundamental drivers supporting the KOSPI's upward trend remain solid, and the KOSPI is currently in an undervalued phase. Given the validity of the upward trend, short-term volatility expansion should be used as an opportunity to increase exposure. Considering year-end consumption momentum and inventory accumulation demand, increasing weights in semiconductors and IT home appliances appears favorable."

Samsung Electronics' robust earnings are also expected to support the stock price's upward momentum. Hana Financial Investment raised its third-quarter operating profit forecast for Samsung Electronics from 15.2 trillion KRW to 15.7 trillion KRW. Kim Kyung-min, a researcher at Hana Financial Investment, explained, "Samsung Electronics' third-quarter earnings are expected to exceed forecasts, supported by profitability improvements in both memory and non-memory semiconductor sectors. The semiconductor business segment's performance is most important, and with good visibility in this segment's earnings, a stock price rebound is anticipated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.