[Asia Economy Reporter Jeong Hyunjin] Amid ongoing discussions in the market about the peak in memory semiconductor prices, a forecast has emerged that prices for server DRAM, which was expected to have relatively stable demand compared to PC DRAM, could fall by up to 5% in the fourth quarter.

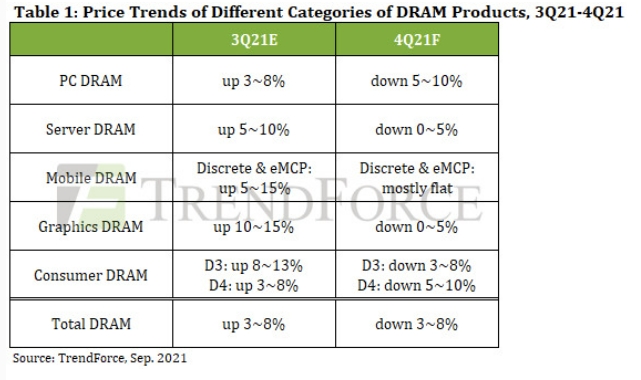

On the 23rd, Taiwanese market research firm TrendForce predicted that DRAM supply will generally exceed demand in the fourth quarter, expecting total DRAM prices to drop by 3-8%. TrendForce stated, "Following the peak production period in the third quarter, supply is expected to surpass demand in the fourth quarter," adding, "The inventory levels of DRAM held by customers have exceeded a healthy range."

In particular, TrendForce forecasted that server DRAM prices will decline by up to 5% in the fourth quarter for the first time this year. North American and Chinese customers, who were concerned about transportation issues, have been accumulating inventory over the past two quarters, resulting in inventory levels exceeding 8 weeks, with some companies holding more than 10 weeks of stock, leaving little room for price increases. Additionally, in the second quarter, the top three DRAM suppliers?Samsung Electronics, SK Hynix, and Micron?converted mobile DRAM production lines to server DRAM, and this effect is expected to gradually manifest in the fourth quarter of this year.

This forecast of falling server DRAM prices is likely to reinforce the theory of a peak in memory semiconductor prices. After TrendForce predicted last month that PC DRAM prices would decline starting in the fourth quarter, the stock prices of major memory semiconductor companies such as Samsung Electronics, SK Hynix, and Micron fell significantly. The semiconductor industry maintains that DRAM demand will increase in the second half of this year or next year, viewing these concerns as excessive. However, if prices fall even for server DRAM, which has larger contract volumes compared to PC DRAM, it is assessed that DRAM suppliers will inevitably be affected in their earnings.

Moreover, TrendForce has expanded its forecasted decline for PC DRAM prices, which were initially expected to fall in the fourth quarter. Last month, PC DRAM prices were expected to drop by 0-5% during the fourth quarter, but the current forecast estimates a decline of up to 10%. TrendForce explained, "With the expansion of vaccination in Europe and North America, global laptop demand is expected to decrease starting in the fourth quarter, which will impact PC DRAM."

Additionally, mobile DRAM, which is expected to see price increases through the third quarter, is forecasted to maintain prices in the fourth quarter, while graphic DRAM is expected to turn to a downward trend.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)