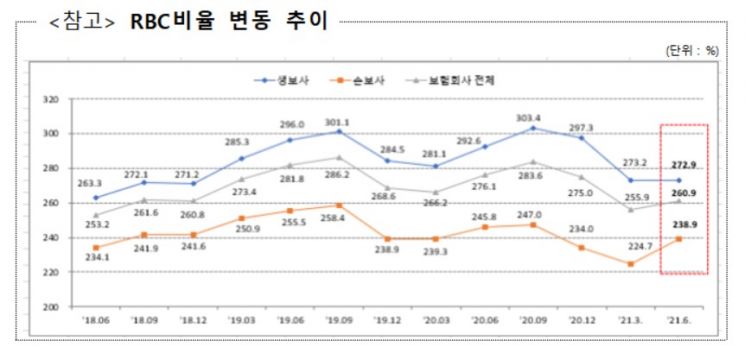

[Asia Economy Reporter Park Sun-mi] The solvency ratio (RBC), a key financial soundness indicator for insurance companies, has slightly improved.

According to the Financial Supervisory Service on the 23rd, as of the end of June, the RBC ratio of insurance companies stood at 260.9%, up 5.0 percentage points from 255.9% at the end of March. The life insurance sector's RBC ratio was 272.9% at the end of June, down 0.3 percentage points from 273.2% at the end of March, while the non-life insurance sector's RBC ratio rose 14.2 percentage points to 238.9% from 224.7% at the end of March.

The RBC ratio is calculated by dividing 'available capital,' which covers losses from various risks, by 'required capital,' the amount needed to cover losses if those risks materialize. The RBC ratio measures the financial soundness of insurance companies and is mandated by the Insurance Business Act to be maintained above 100%.

Available capital increased by 4 trillion KRW due to factors such as net income realization (1.8 trillion KRW), issuance of subordinated bonds (1.9 trillion KRW), and capital increase through paid-in capital (0.5 trillion KRW). Meanwhile, required capital increased by only 0.4 trillion KRW due to an increase in insurance risk from higher premiums (0.4 trillion KRW), credit risk from increased operating assets (0.5 trillion KRW), and the effect of other risk changes from regulatory improvements (-0.5 trillion KRW).

Among insurance companies, MG Sonbo (MG Non-life Insurance) is the only one with an RBC ratio below 100% at 97% as of the end of June. This is the first time in 2 years and 9 months that MG Sonbo's RBC ratio has fallen below 100%.

A Financial Supervisory Service official stated, "The RBC ratio of insurance companies is 260.9%, significantly exceeding the 100% standard required to fulfill insurance payment obligations," adding, "We plan to strengthen monitoring of domestic and international interest rate fluctuations and the impact of COVID-19 spread, and if there are concerns about RBC ratio vulnerabilities, we will supervise to enhance financial soundness through proactive capital expansion inducement."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.