[Asia Economy Reporter Lee Seon-ae] Recently, market returns have somewhat slowed down, and since the fourth quarter is a period when dividend expectations expand, investment advice has been raised to focus on companies with high dividend yields.

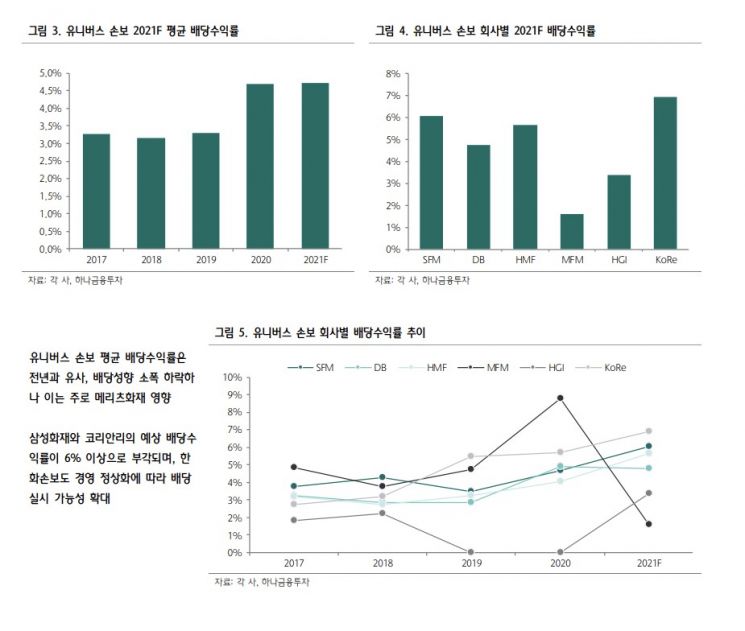

According to Hana Financial Investment on the 22nd, the estimated dividend yield of Universe Insurance in 2021 is an average of 4.7%. This is similar to the previous year because Meritz Fire & Marine Insurance reduced its dividend payout ratio to 10% starting this year. Excluding Meritz Fire & Marine Insurance, the average is estimated to increase by +1.5 percentage points to 5.4% compared to the previous year. The actual dividend yield may be even higher. Although the Q3 earnings preview update has not yet been released, the preliminary loss ratio for automobile insurance in July and August is significantly better than previously estimated, and the long-term expense ratio has also improved, so the Q3 performance of non-life insurers is likely to exceed previous estimates. Additionally, although concerns about a decline in the RBC ratio due to rising interest rates have increased, it was defended through the issuance of supplementary capital, so the possibility of a decline in the dividend payout ratio compared to the previous year is very limited.

The expected dividend yields by company are estimated as follows: Samsung Fire & Marine Insurance 6.1%, DB Insurance 4.8%, Hyundai Marine & Fire Insurance 5.7%, Meritz Fire & Marine Insurance 1.6%, Hanwha General Insurance 3.4%, and Korean Reinsurance Company 6.9%. Researcher Lee Hong-jae of Hana Financial Investment recommended, "From a dividend perspective, the stocks of interest are Samsung Fire & Marine Insurance and Korean Re."

Although the regulations for calculating distributable profits have not yet been finalized, it is expected that DPS will increase due to profit growth upon the introduction of IFRS17. However, it is anticipated that dividends (DPS) will not rise exactly in proportion to the increase in profits; in other words, the dividend payout ratio may be slightly reduced. The reason is that volatility in CSM may somewhat increase during the initial transition period, and there is significant room for capital fluctuation if LTFR declines. Nevertheless, the possibility of DPS itself increasing due to profit growth is high, and with the improvement in companies' ALM and the smoothing of profit and loss recognition patterns, the mid- to long-term dividend visibility is expected to improve significantly with the introduction of IFRS17 and K-ICS.

The researcher added, "In the case of Korean Re, since the solvency ratio under K-ICS is likely to improve compared to the current RBC, unlike most primary insurers, it is judged that the dividend payout ratio can trend upward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.