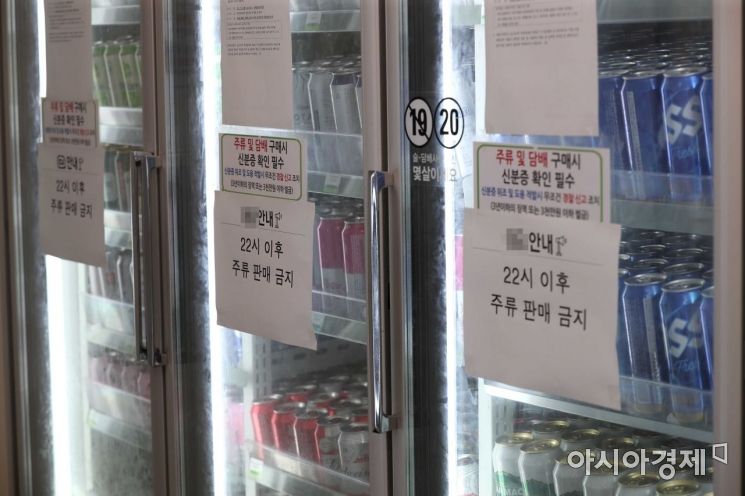

Due to the rapid increase in COVID-19 cases, nighttime drinking has been banned at locations such as Hangang Park and Cheonggyecheon Stream in Seoul. On the 7th, a notice stating "No alcohol sales after 10 PM" was posted at a convenience store in Yeouido Hangang Park, Seoul. Photo by Mun Ho-nam munonam@

Due to the rapid increase in COVID-19 cases, nighttime drinking has been banned at locations such as Hangang Park and Cheonggyecheon Stream in Seoul. On the 7th, a notice stating "No alcohol sales after 10 PM" was posted at a convenience store in Yeouido Hangang Park, Seoul. Photo by Mun Ho-nam munonam@

[Asia Economy Reporter Minji Lee] As high-intensity social distancing measures continue due to the spread of COVID-19, the stock prices of beverage and liquor companies are showing mixed results. While HiteJinro is expected to see a significant decline in sales in its liquor division, Lotte Chilsung's stock price is positively reflecting expectations of improved performance in its beverage and craft beer divisions.

Looking at HiteJinro's stock price on the 22nd, it fell about 12% over the past three months from 38,900 KRW to 34,050 KRW. This decline is analyzed as reflecting the outlook for decreased earnings amid ongoing stringent social distancing measures. In contrast, Lotte Chilsung recorded a relatively favorable stock return, rising about 0.67% over the past three months.

According to financial information provider FnGuide, securities firms estimate HiteJinro's operating profit for the third quarter at 57.4 billion KRW, a 10.87% decrease compared to the same period last year. Sales are expected to decrease by 1.39% to 615.6 billion KRW. Due to the impact of high-intensity social distancing in the second half of the year, operating profit estimates have been continuously revised downward; two months ago, securities firms estimated HiteJinro's operating profit at around 66.6 billion KRW.

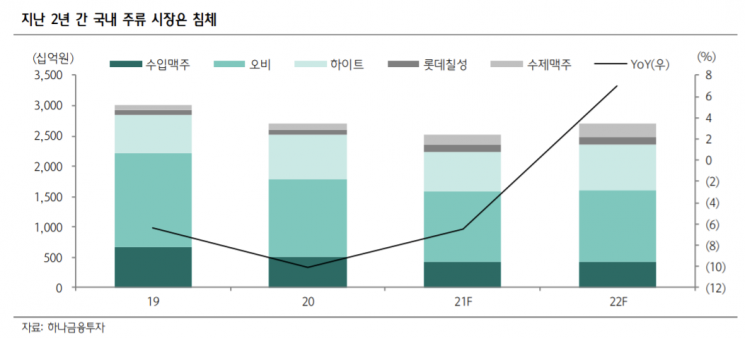

HiteJinro is expected to see weak sales performance in both soju and beer segments. According to IBK Investment & Securities, beer segment sales are projected at 222.8 billion KRW with an operating profit of 5.8 billion KRW, representing decreases of 8.7% and 69.4%, respectively. The domestic beer market shrank by about 10% in the second quarter due to social distancing effects, and the market contraction is expected to continue into the third quarter. The soju market size is expected to decline by about 5%, with estimated sales and operating profit at 330.3 billion KRW and 41.3 billion KRW, down 1.4% and 7.9% year-on-year, respectively.

Kim Taehyun, a researcher at IBK Investment & Securities, said, "Major competitors are strengthening regular beer marketing and increasing new craft beer product launches in the home-use channel, inevitably impacting sales of regular beer and sparkling beer. Although high-intensity social distancing measures have been prolonged, the ongoing spread of COVID-19 means that meaningful sales recovery in the dining and entertainment markets for the remainder of this year is expected to be limited."

In the case of Lotte Chilsung, sales expansion in the beverage division and increased sales of craft beer and wine are expected to continue improving performance. According to NH Investment & Securities, beverage division sales are forecasted at 493.4 billion KRW with an operating profit of 71.5 billion KRW, representing growth of 10.5% and 30.3% year-on-year, respectively. In the beverage division, the pressure from rising raw material costs is being offset by price increases, and strong sales of high-margin zero-calorie carbonated drinks and bottled water, along with favorable weather, are expected to achieve the highest quarterly performance. The liquor division is estimated to record sales of 180.4 billion KRW and operating profit of 2 billion KRW, increases of 5% and 100% compared to a year ago.

Jo Mijin, a researcher at NH Investment & Securities, analyzed, "Although soju sales will decline compared to last year due to strengthened social distancing, operating profit is expected to increase year-on-year due to growth in regular beer sales, craft beer OEM, and wine sales."

However, both companies are expected to benefit if social distancing measures are eased as vaccination rates rise. Shim Eunju, a researcher at Hana Financial Investment, said, "If 'With Corona' is implemented by the end of the year, a recovery in total liquor demand is expected to become visible. Even if the liquor market only recovers to the level of 2020, the first year of the COVID-19 outbreak, the 2022 liquor market is projected to grow by about 7%, suggesting a meaningful base effect next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman Who Jumps Holding a Stolen Dior Bag... The Mind-Shaking, Bizarre Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)