No Action Will Be Taken for Violations Only During the Supplementary Period

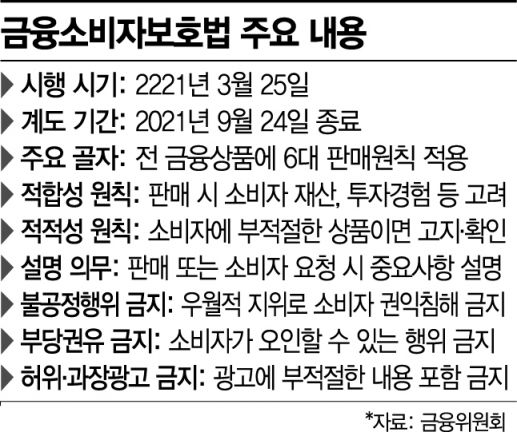

[Asia Economy Reporter Park Sun-mi] As the grace period for the Financial Consumer Protection Act (FCPA) ends on the 24th, financial authorities have decided to continue supplementing the explanatory documents for investment products by financial companies until the end of the year and will not take action against violations during this supplementation period.

On the 22nd, the Financial Services Commission and the Financial Supervisory Service conducted a regional inspection of the preparation status across all sites ahead of the end of the FCPA grace period and determined that improvements were needed in ▲investment product explanatory documents ▲delays in loan broker registration ▲violations of the FCPA by online platforms.

Initial difficulties at the field level, such as longer product explanation times and unprepared electronic systems for providing contract documents, were largely resolved through guidelines established during the grace period. However, the revision of investment product explanatory documents in accordance with the purpose of the FCPA has been delayed on site, necessitating further supplementation. Financial authorities announced that they will work with the Korea Financial Investment Association to complete these improvements within this year.

Additionally, it is difficult to complete the registration of loan brokers (small and medium corporations, individuals) and lease/installment brokers who have been operating before the FCPA enforcement by the 24th. The period for verifying disqualification reasons through related agencies took longer than expected, and the registration applications for lease/installment brokers, which had not been managed by the association until now, were delayed. Accordingly, financial authorities plan to complete the registration of existing loan brokers who apply by October 24th within this year.

Furthermore, reflecting the fact that online financial platforms were generally unprepared for the broker registration regulations under the FCPA, authorities plan to respond by distinguishing between companies that recognized the authorities’ policy during the grace period and agreed to make corrections, and those that did not. In the former case, services must be suspended after the 25th until legal issues are resolved, but in the latter case, even after the 25th, if a correction plan is promptly submitted to the authorities within the year and legal issues are resolved without delay, no action will be taken in principle.

A financial authority official stated, "Based on the inspection of field preparation status, unless there are special circumstances, no action will be taken during the supplementation period for insufficient areas," and added, "We will provide financial companies with self-inspection checklists and, if necessary, non-action opinion letters to help resolve difficulties in applying the law."

Meanwhile, the Financial Services Commission, Financial Supervisory Service, and associations reported that during the grace period, they made efforts to alleviate inconveniences in the financial product sales field by preparing four guidelines: ▲advertising regulation guidelines ▲investor suitability assessment system operation guidelines ▲guidelines for the reasonable fulfillment of financial product explanation obligations ▲regional standard internal control standards.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)