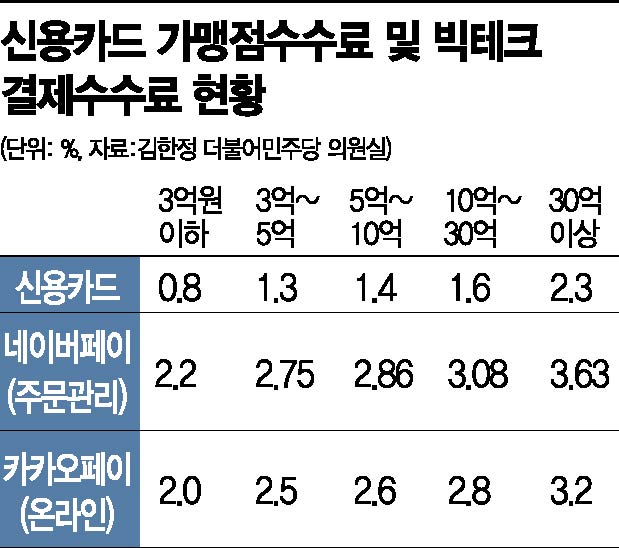

'Franchise Fees of 0.8~1.6% for Stores with Annual Sales Under 3 Billion KRW

Big Tech Payment Fees Range from 2.0 to 3.08%'

[Asia Economy Reporter Ki Ha-young] The dispute over commission rates between big tech companies (large information and communication companies) and card companies is reigniting. This is due to worsening business conditions for small self-employed businesses amid the prolonged COVID-19 pandemic, sparking discussions on lowering commission rates, mainly in the political sphere.

According to the office of Kim Han-jung, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, as of the end of last month, the commission rates for card companies' preferred merchants with annual sales of 3 billion KRW or less ranged from 0.8% to 1.6%, whereas big tech payment commissions were found to be between 2.0% and 3.08%. For small business owners with annual sales of 300 million KRW or less, the credit card commission rate was 0.8%, while Naver Pay's order-based payment commission was 2.2%, nearly three times higher.

Rep. Kim stated, "Big tech companies like Naver Pay and Kakao Pay have grown significantly due to the COVID-19 windfall, but their willingness to participate in coexistence and sharing the burden in our society is weak," emphasizing, "It is necessary to actively promote the reduction of big tech payment commissions as a way to share the pain of small business owners and self-employed individuals struggling due to COVID-19."

In response, Naver Financial, which operates Naver Pay, argued that it is not a comparable subject to credit card companies. They claim that the actual commission rate, excluding fees paid to credit card companies and order management fees, is only 0.2% to 0.3%.

Naver Financial explained, "The commission consists of merchant fees paid to credit card companies and fees related to the role of the Payment Gateway (PG) company, which bears risks such as losses from bankruptcies of low-credit online shopping malls," adding, "Order-based payment commissions include not only PG functions but also various services such as sales management including shipping, exchanges, and returns, delivery tracking, fast settlement support, and fraud detection system (FDS)." They argued that since order management-type Naver Pay provides multiple additional services, it is inappropriate to directly compare it with credit card fees that only provide payment functions. They also emphasized that both Naver Pay's payment and order management fees are among the lowest in the industry.

However, the card industry points out that big tech companies providing the same payment functions are exempt from regulations amid the rapid growth of the simple payment market. Card companies adjust commission rates every three years through a re-estimation of eligible costs under the Specialized Credit Finance Business Act, but big tech companies have no provisions related to commissions under the Electronic Financial Transactions Act. An industry insider said, "Services such as settlement support, fraud prevention, and member management, excluding sales management like shipping and exchanges, are already provided by card companies," and criticized, "It is unfair that big tech companies providing the same payment services in the rapidly growing simple payment market are subject to differentiated regulations."

According to the domestic payment trends for the first half of 2021 announced by the Bank of Korea, the average daily payment amount via mobile devices was 1.128 trillion KRW, of which simple payment service usage accounted for 467 billion KRW daily, representing 41.1% of the total. Notably, fintech companies accounted for 63% of the simple payment service usage amount, reaching an average daily amount of 294 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.