[Asia Economy Reporter Minji Lee] Following Oracle's earnings announcement, the stock showed a slight decline, with opinions suggesting that for the stock to rebound, growth in the cloud segment must be clearly reflected in the financial results.

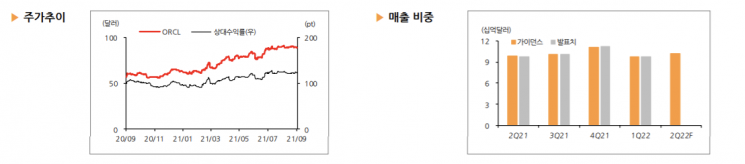

According to the financial investment industry on the 20th, Oracle's stock price fell about 3% this month, from $89.13 to $86.39. After the earnings announcement on the 14th (local time), the stock price declined, which is analyzed to be due to the results falling short of expectations.

Looking at the recently announced Q1 (June-August) earnings indicators, revenue was $9.73 billion, and adjusted operating income was $4.3 billion, representing growth of 3.9% and 3.7% respectively compared to the same period last year. Adjusted EPS was $1.03, exceeding market expectations ($0.97), reflecting a slightly lower corporate tax rate than expected and the effect of aggressive share buybacks. While maintaining stable earnings, revenue fell short of the market expectation of $9.77 billion.

By segment, cloud services and license support revenue recorded $7.37 billion, up 6% year-over-year. Cloud and on-premises license revenue was $810 million, an 8% increase compared to the previous year. Hardware revenue decreased by 6% to $760 million, while services revenue increased by 8% to $780 million. By region, the U.S. market grew by 5%, and sales in Europe, the Middle East, Africa, and Asia-Pacific increased by 2% and 4%, respectively.

The most important indicator in Oracle's earnings is the performance and proportion of the cloud business. Total cloud revenue is approximately $2.5 billion, accounting for about 25% of total revenue. Since the legacy IT proportion remains high at around 65%, trend-based revenue growth has yet to meet expectations.

In Q1, cloud-based application revenue growth exceeded 25%, but total application revenue growth was around 7%. Overall infrastructure services revenue grew by about 3%, but cloud infrastructure services revenue growth rate was in the mid-30% range. Jaeim Kim, a researcher at Hana Financial Investment, said, "Compared to the big three cloud IaaS providers, Oracle, as a latecomer employing an aggressive growth strategy, is growing at a somewhat disappointing pace."

The Q2 guidance projects revenue growth of 3-5% and adjusted EPS of $1.09 to $1.13, which is higher than the market expectation of $1.09. Currently, Oracle is actively investing to expand the cloud revenue proportion and maintains a very confident tone regarding future growth prospects. The influx of large financial companies as new customers and increased use of Fusion ERP and NetSuite ERP help maintain its number one market share in the ERP cloud industry, which is also positive.

However, the fact that this competitiveness has not yet been clearly reflected in the earnings is a concern. Researcher Jaeim Kim said, "Oracle's strengths as a stable value stock with an aggressive share buyback policy significantly reduce downside risk," adding, "To expect stock price momentum, success in the cloud growth strategy must first be confirmed through earnings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.