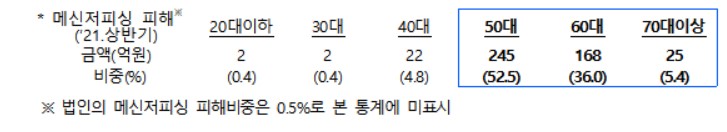

Significant Increase in Messenger Phishing Victims Among Adults Aged 50 and Over

[Asia Economy Reporter Park Sun-mi] Messenger phishing damage is significantly increasing, especially among middle-aged and older adults aged 50 and above, so special caution is needed to prevent such damage.

According to financial authorities on the 20th, if you receive a message from an unknown phone number or via KakaoTalk asking for identification or financial transaction information while claiming to be your son or daughter, you should keep in mind that it is highly likely to be messenger phishing.

Before replying by text, it is necessary to confirm by phone call whether the message was actually sent by your son or daughter. Under no circumstances should you provide identification, account numbers, passwords, etc., and you must never click on URLs (remote control apps).

If you have provided identification and financial transaction information and installed a malicious app due to messenger phishing, you should report the damage to the financial company and either reset your mobile phone or delete the malicious app. Also, access the Financial Supervisory Service’s personal information exposure accident prevention system to register the fact of personal information exposure and restrict new account openings and credit card issuances.

Furthermore, by accessing the Korea Financial Telecommunications & Clearings Institute’s integrated account information management service and checking the 'Detailed information on deposit and loan accounts opened under your name (bank, account number, opening date, balance, etc.)' in the My Account at a Glance menu, if you find accounts opened by identity theft or non-face-to-face loans executed, you should immediately report the damage and request payment suspension at the relevant financial company. You can also check whether a mobile phone has been opened under your name fraudulently by accessing the Korea Information & Communication Promotion Association’s identity theft prevention service.

If you have been a victim of fraud, you should immediately request payment suspension at the call center of the relevant financial company, the police agency, or the Financial Supervisory Service. After applying, you can obtain a confirmation of the incident from the police station (cyber investigation unit) and submit it to the financial company branch within 3 days to apply for a refund of the damaged funds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.