[Asia Economy Reporter Ji Yeon-jin] As the U.S. consumer price inflation shows signs of slowing down, there is a forecast that the profits of small and mid-cap stocks will improve more than those of large-cap stocks.

According to the financial investment industry on the 20th, the U.S. producer price inflation rate in August exceeded market expectations and rose compared to the previous month. The wage growth rate in the same month also recorded a surprise.

It is analyzed that wage pressure increased mainly in industries showing signals of labor shortages.

However, companies are responding to macro environment changes faster than market expectations. Since the second half of last year when supply chain disruptions occurred, both the S&P 500 operating profit margin and net profit margin have rebounded rapidly. Corporate margin rates are expected to remain at levels higher than before COVID-19 even after the second half of this year.

This expectation is interpreted as companies strategically responding well to rising costs. When comparing the unit costs of non-financial companies and the intensity of output price increases, price pass-through proceeded at the strongest level since the 1970s in the first half of this year. An So-eun, a researcher at KB Securities, said, "Price pass-through by companies has already progressed significantly, and its intensity is expected to gradually weaken," adding, "By dividing producer prices by processing stages and comparing them together with consumer prices, we examined the ripple process of price increases from production to consumption. Among producer prices, the inflation rate at the initial stage, which is close to raw materials, has passed its peak."

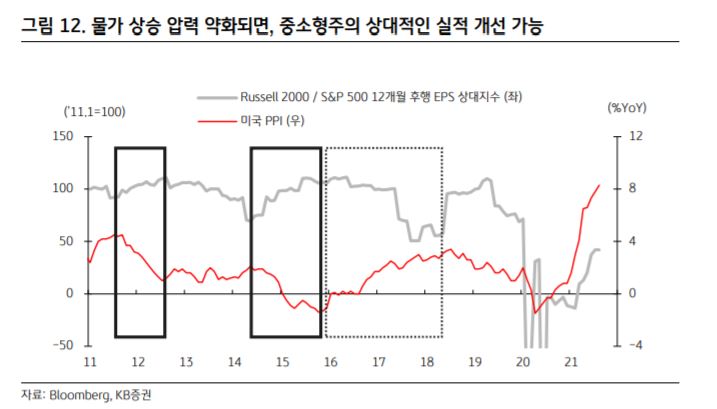

As inflationary pressure weakens and companies complete price pass-through, changes are expected in corporate margins and profit flows. In terms of profits, an environment more favorable to small and mid-cap stocks than large-cap stocks is anticipated. Researcher An said, "For large-cap stocks, which have actively passed on price increases so far, the justification for price hikes disappears, whereas for small and mid-cap stocks, which found price pass-through relatively difficult, the risk of margin deterioration is alleviated."

In fact, between 2016 and 2018, when producer prices rose and cost burdens increased, the performance of small and mid-cap stocks lagged behind large-cap stocks because although sales growth was stronger for small and mid-cap stocks, margins deteriorated. On the other hand, in 2011-2012 and 2014-2015, when producer price inflation rates were lower, small and mid-cap stocks showed relatively strong performance supported by margin improvements, according to researcher An.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)