Hana Financial Investment Report

[Asia Economy Reporter Minji Lee]Anta Sports is expected to maintain steady growth in the second half of the year.

According to the financial investment industry on the 18th, Anta Sports recorded 156.700 Hong Kong dollars, down 2% since the beginning of this month. This is considered a lower level compared to the strong stock price in July (around 180 dollars). It appears that concerns about sales impact due to COVID-19 have been reflected in the stock price.

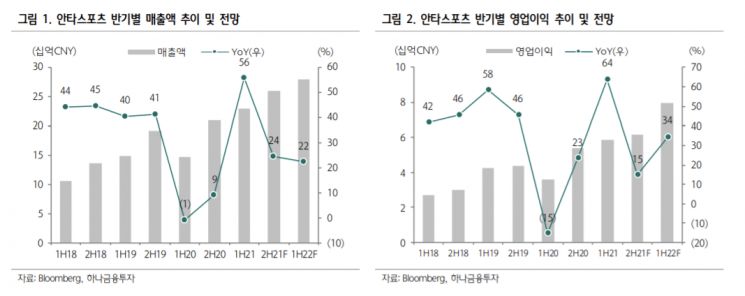

In the first half of the year, Anta Sports' sales increased by 56% year-on-year to 22.8 billion yuan, exceeding market expectations by 4%. Net profit was 3.8 billion yuan, up 132% from a year ago. Despite a high base from a year ago, the company's e-commerce sales increased by 61%, contributing about 27% to total sales.

Specifically, Anta Sports' sales growth rate turned positive after one year, growing by 56%. FILA's sales growth rate also increased by 51% compared to a year ago. With the expansion of direct sales channels, Anta's GPM reached an all-time high of 53%, but operating profit margin declined due to increased store rent and labor costs.

Seunghye Baek, a researcher at Hana Financial Investment, explained, "Anta Sports is currently employing a direct sales channel strategy similar to Nike," adding, "The proportion of agency store sales was 67% in the first half of last year, but this changed to 31% for agency stores and 35% for direct-to-consumer (DTC) stores in the first half of this year." Nike's direct sales ratio was similarly expanded to 35% based on last fiscal year.

According to management, Anta Sports recorded high sales growth in July, but sales in August were inevitably hit by floods in Henan Province and the resurgence of COVID-19. However, recovery has been observed since late August, and the recovery trend is expected to continue in September.

Currently, Anta Sports aims to maintain the growth rate of mass products under its own brand Anta while increasing the sales proportion of high-end products from the current 10% to 30%. The average selling price of the Chinese national team series products is planned to be set at twice that of existing products. Additionally, by increasing the SKU of women's products, the total gross merchandise volume (GMV) is planned to expand fourfold within five years from less than 5 billion yuan currently to 20 billion yuan by 2025. Researcher Baek stated, "To strengthen product competitiveness over the next five years, 4 billion yuan will be invested in research and development, and global design centers will be established in Japan, Korea, Italy, and the United States."

Finally, Researcher Baek said, "Sales in the second half of this year and the first half of next year are expected to grow by the 20% range compared to a year ago, and net profit is also expected to show steady growth of 22% and 40%. In the fourth quarter, the recovery of the offline consumption market in China and the hosting of the Beijing Winter Olympics early next year are expected to restart stock price momentum."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.