[Asia Economy Reporter Lee Seon-ae] "If you want to know the KOSPI trend, look at Amazon's stock price." An analysis showing a high correlation between Amazon's stock price and the KOSPI index is attracting investors' attention.

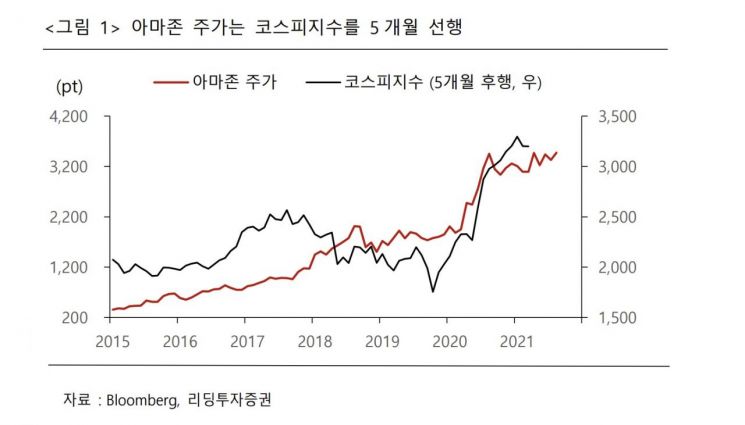

According to Leading Investment & Securities on the 18th, Amazon's current stock price and the KOSPI index about five months later show a high similarity. A lag correlation analysis based on month-end closing prices from 2015 to 2020 revealed a correlation coefficient of 0.69.

In fact, a graph overlaying Amazon's stock price and the KOSPI index lagging by five months shows almost the same directional movement from 2015 to the present in 2021.

Although this graph pattern may seem coincidental at first glance, researcher Byung-yeol Kwak of Leading Investment & Securities inferred the reason for the stock price's leading nature from the supply chain relationship between Amazon and major domestic export companies. Researcher Kwak explained, "The online store (third-party intermediary segment), which accounts for most of Amazon's sales, and the cloud segment, which accounts for 10% of sales, are related to the near-future order levels of domestic export companies such as semiconductor manufacturers."

He continued, "If Amazon's stock price rose five months ago, it suggests the possibility of strong Amazon sales, and with a time lag, the expectation of improved exports by domestic companies tends to be reflected in the index."

If the KOSPI index indeed shows the same directional movement as Amazon's stock price with a five-month lag, it is possible to predict the domestic stock market trend from after the Chuseok holiday through the end of this year. Researcher Kwak said, "If Amazon's monthly return was positive five months before the Chuseok holiday, the monthly return of the domestic stock market in the month including the Chuseok holiday was also positive," adding, "This same directional trend was observed six times from 2015 to 2020." Assuming this trend repeats, since Amazon's monthly return in April, five months ago, was 12%, it is highly likely that the stock price will record a positive monthly return this month as well.

Amazon's stock price recorded -7.04% in May, 6.73% in June, -3.27% in July, 4.30% in August, and -0.39% as of September 13. A period of adjustment characterized by alternating one-month gains and one-month losses is occurring. Applying this to the KOSPI index five months later suggests a high possibility of a box range period adjustment phase continuing until the end of the year.

Researcher Kwak stated, "Estimating this as the KOSPI five months later, it is likely that a box range market with a period adjustment phase will prevail until the end of the year," and explained, "Amazon's stock price showing this trend can be interpreted as largely reflecting the fact that Amazon's EPS forecast entered a contraction phase in the third and fourth quarters compared to the same period last year."

He added, "Amazon's EPS growth rate remains strong at 25% in 2021 and 26% in 2022 on an annual basis, maintaining its status as a representative growth stock, which limits the possibility of a sharp stock price decline," emphasizing, "Applying this to the lagging KOSPI, the year-end special demand in developed countries, China's Singles' Day, and the year-end consumption season effects, along with improved earnings visibility, can maintain downside rigidity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)