UK Stock Market Achieves 3% Return in One Month Since July's With-Corona Transition

Luxury Goods Like High-End Cars, Cosmetics, and Gambling Drive Revenge Spending Impact

[Asia Economy Reporter Ji Yeon-jin] As the COVID-19 vaccination rate increases domestically, discussions on transitioning to 'With Corona (coexistence with COVID-19)' are intensifying, drawing attention to its impact on the stock market and investment sectors.

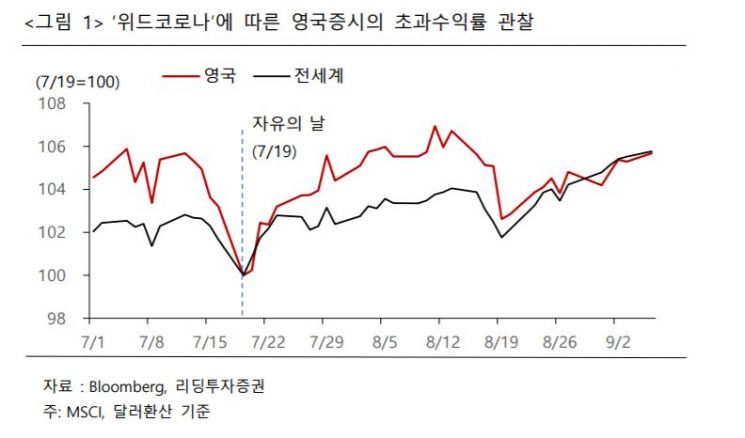

According to the financial investment industry on the 18th, the UK showed a stronger stock market performance compared to the global market after easing quarantine regulations in July based on a high vaccination rate. According to an analysis by Leading Investment Securities, the UK's cumulative excess return one month after With Corona reached up to 3%. Compared to global sector indices, excess returns were observed in consumer discretionary (7.3%p), energy (5.1%p), IT (3.7%p), and industrials (3.4%p). Researcher Byung-ryeol Kwak of Leading Investment Securities explained, "The economic normalization expectations due to With Corona are presumed to be linked to a strong rebound in consumer discretionary and IT sectors related to improved durable goods consumption sentiment, and energy and industrial sectors due to the normalization of production facility operating rates following the lifting of economic lockdowns."

Among the FTSE 100 index constituents, the top 5 performing stocks were Rolls-Royce (automobiles, 22.3%), CRODA INTERNATIONAL (cosmetic raw materials, 18.9%), JUST EAT TAKEAWAY.COM (food delivery, 18.4%), Flutter Entertainment (sports betting, 14.7%), and Taylor Wimpey (real estate development, 14.3%). Notably, UK stock market participants showed a strong preference for luxury goods and entertainment sectors such as high-end cars, cosmetics, and gambling. This is interpreted as pent-up consumer sentiment during the COVID-19 lockdown phase being expressed as 'revenge consumption.'

However, the UK's stock market's With Corona effect lasted only about one month. The explosive surge in confirmed cases after lifting COVID-19 restrictions and weak economic indicators hindered the market. Researcher Kwak stated, "Only when COVID-19 case management is possible through phased easing rather than a full-scale lifting like in the UK, can the domestic stock market's 'With Corona' effect be extended. He added, "The strong performance of luxury goods and entertainment sectors such as high-end cars, cosmetics, and gambling in the UK is expected to be replicated in the domestic stock market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.