Recommendation to Close Exchanges Failing to Meet ISMS Certification Requirements by the 17th

Partial Closures Inevitable... Cryptocurrencies Not Tradable on Other Exchanges Should Be Cashed Out Quickly

[Asia Economy Reporter Gong Byung-sun] As the deadline approaches for the closure of virtual currency exchanges that have not secured real-name accounts and Information Security Management System (ISMS) certification, some exchanges are either giving up on KRW trading or shutting down. To minimize losses, it is advisable to transfer virtual currencies in advance through wallets or quickly convert coins that are only traded on the respective exchanges into cash.

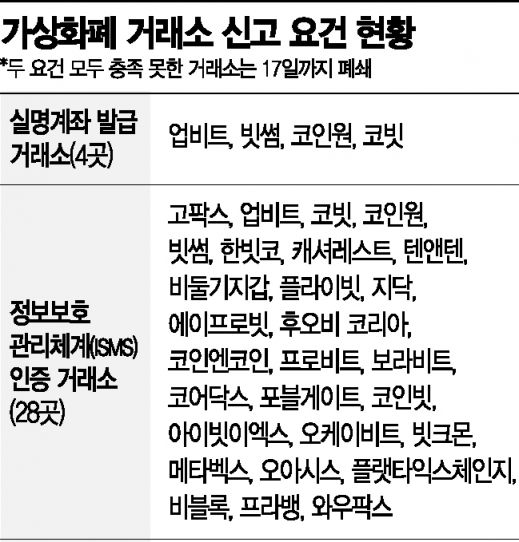

According to financial authorities on the 17th, among the virtual currency exchanges whose locations have been identified so far, 28 have obtained ISMS certification. However, only four exchanges?Upbit, Bithumb, Coinone, and Korbit?have been issued real-name accounts by banks.

According to the amendment to the Act on Reporting and Using Specified Financial Transaction Information, domestic virtual currency exchanges must complete registration with the Financial Intelligence Unit (FIU) by the 24th to continue operations. The registration requirements are ISMS certification and issuance of real-name accounts. Exchanges that obtain only ISMS certification can continue operations but must suspend KRW trading. Exchanges that fail to obtain both ISMS certification and real-name accounts must, according to financial authorities’ recommendations, announce their business closure schedule and user asset refund methods on their websites by the 17th and notify individual members as well.

Accordingly, exchanges that have not been issued real-name accounts are hastily giving up KRW trading and preparing Bitcoin markets. Domestic exchange Probit announced via its website that it will suspend KRW trading from the 23rd and convert all trading to coin markets. KRW deposits will be restricted from 10 a.m. on the 17th, and KRW withdrawals will be possible until 10 a.m. on October 22. Foblegate will also operate as a coin market from the 23rd.

However, exchanges that have not even obtained ISMS certification are expected to proceed with closure procedures as is. This is because obtaining ISMS certification takes at least three months after application. Among the exchanges that have not applied, sites such as David, Bitbay Korea, and Bitkini are currently inaccessible. Exchanges like Wannabit and Spowide have already ceased operations and closed.

With the wave of exchange closures becoming a foregone conclusion, investor losses are also a concern. If investors have invested in well-known virtual currencies such as Bitcoin or Ethereum, they can transfer their virtual currencies to other exchanges via wallets before closure. However, if they have purchased Kimchi coins (virtual currencies issued domestically) that are not traded on other exchanges, the Kimchi coins will disappear along with the closure. Especially, investors using small- and medium-sized exchanges tend to seek volatility and are presumed to have mostly invested in Kimchi coins. Furthermore, since announcements regarding business closure schedules and asset refund methods are only recommendations by financial authorities, there may be victims unaware that their Kimchi coins have disappeared.

An industry insider explained, "Kimchi coins cannot be disposed of even if transferred to virtual currency wallets, so they should be converted to cash as soon as possible, even at a low price," adding, "Even exchanges that have only obtained ISMS certification will see a significant drop in trading volume if they operate only Bitcoin markets, which will cause losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)