Internet Banks Raise Mid-Interest Rate Targets One After Another Amid Authorities' Warnings

K-Bank Even Says "Will Pay 100% Interest for Two Months"

Savings Banks Launch Loans for Medium Credit Borrowers with Single-Digit Interest Rates

Concerns Arise Over Whether the Mid-Interest Rate Market Will Also Become a Regulatory Target

[Asia Economy Reporter Song Seung-seop] The reason why competition for ‘mid-interest rate loans’ is active amid strong loan regulations is largely attributed to the financial authorities’ ‘carrot and stick’ approach. To resolve the interest rate gap issue, the financial authorities have either provided incentives for mid-interest rate loans or excluded them from loan regulations. If smooth supply does not occur, they have applied pressure to secure commitments for mid-interest rate loan supply. Concerns that regulating mid-interest rate loans as well, while the government and financial authorities are considering additional loan regulations, would inevitably harm low-income and real demand borrowers are also cited as factors fueling competition among financial companies. With the annual total loan volume limit demanded by the authorities nearly reached, mid-interest rate loans offer a way to overcome the limits of credit business.

According to the financial industry on the 17th, the sector most aggressively supplying mid-interest rate loans is internet-only banks. KakaoBank executed 502 billion KRW in unsecured credit loans for mid- to low-credit borrowers over the past three months. Of this, 300.4 billion KRW was disbursed in August alone, an increase of about 160% compared to the previous month. Last month, it also launched new products for mid-credit borrowers, such as the ‘Mid-Credit Plus Loan’ and ‘Mid-Credit Emergency Loan.’

K Bank also announced that starting from the 16th, it will fully refund two months’ worth of interest to retain mid-interest rate loan customers. The target group is mid-credit borrowers with credit scores of 820 or below who take out new credit loans by the end of next month. Additionally, it plans to improve its Customer Credit Scoring (CSS) model to increase loan opportunities and enhance interest rate benefits.

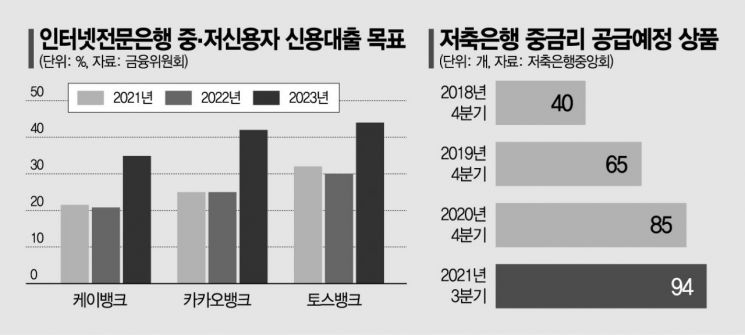

Toss Bank, which is about to launch, has declared that it will expand the proportion of mid-interest rate loans to 34.9% this year, higher than KakaoBank and K Bank’s target of the 20% range.

Many view the internet banks’ focus on mid-interest rate loans as driven by the authorities’ ‘stick.’ Internet banks initially announced they would concentrate on products for mid- to low-credit borrowers. However, after launching, they focused on high-credit borrowers, prompting the Financial Services Commission in May to warn that "the proportion of credit loans to mid- and low-credit borrowers is lower than that of commercial banks," and that "performance will be re-examined, plans reviewed, and gradual expansion enforced."

Providing volume leeway and considering incentives... greatly expanding the mid-interest rate market

On the other hand, savings banks are supplying groundbreaking mid-interest rate products thanks to the financial authorities’ ‘carrot.’ Industry leader SBI Savings Bank recently launched the ‘79 Loan,’ a credit loan product. It offers a fixed interest rate of 7.5% to 9.4% annually, with a maximum loan limit of 100 million KRW. Eligible borrowers are mid- to low-credit individuals over 20 years old or with a credit score of 670 or higher. ES Savings Bank launched the ES Needs Loan product with a minimum interest rate of 4.8%, a mid-interest rate loan product for salaried workers who can provide income verification. The loan limit ranges from 1 million to 100 million KRW.

Savings banks must limit household loans to 21.1% compared to the end of the year, but mid-interest rate loans or policy finance loans are allowed at 15.7%, more generous than high-interest loans (5.4%). As long as the reduced mid-interest rate requirement (16%) is met, relatively active credit business is possible. Incentives such as expanding the business area up to 150% based on mid-interest rate loan performance or awarding bonus points in management evaluations are also being considered.

The online investment industry, which completed official registration at the end of August, is promoting mid-credit borrower funding through technology finance. Applying a P2P model means that ‘thin filers’ (people with insufficient financial history), who are difficult for traditional financial institutions to serve, can also borrow at mid-interest rates. In fact, most mid-interest rate loans in the online investment industry are refinancing products for those switching from savings banks or loan companies.

The problem is that as the mid-interest rate market becomes a battleground, there are concerns it could become a target of financial authorities’ regulations. Loan products that were exempt from regulation for real demand borrowers and low-income groups may be managed depending on debt levels. A representative example is that mid-interest rate loans from savings banks were excluded from total volume regulations but later included. A financial industry official explained, "We thought jeonse loans would also be free from regulation, but there are talks that they might not be," adding, "It is a policy risk that is difficult to predict when and how tightening will occur."

Experts point out that uniformly tightening mid-interest rate loans to achieve debt control goals is inappropriate. Professor Sung Tae-yoon of Yonsei University’s Department of Economics said, "It is problematic to block loans after confirming they are for real demand," and added, "If income and credit are deemed appropriate, loans should be provided accordingly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.