Effect of Tightening Household Loans in the Financial Sector

Four Major Banks Increase Share of Mid-Interest Loans

High-Credit Borrowers' Share Declines Monthly

Park Sun-hyun (48, pseudonym), who runs a bakery in Gwanak-gu, Seoul, recently borrowed 15 million won at an annual interest rate in the 5% range from a commercial bank to cover the remaining payment for a jeonse (long-term deposit) house. Since he already had considerable debt for operating his store, Park thought it would be difficult to get a bank loan, but contrary to his expectations, he was able to secure a loan at a relatively low interest rate. He said, “Since I am not a high-credit borrower, I was planning to use internet banks or savings banks, but I was surprised when the bank I visited on a friend's recommendation said I could get a loan.” He added, “I was told that the bank had advanced its Credit Scoring System (CSS), which led to a higher evaluation of my income repayment ability despite being a medium-credit borrower.”

[Asia Economy Reporter Song Seung-seop] Amid a strong household loan management stance spreading across the entire financial sector, it has been identified that commercial banks have rapidly increased the proportion of medium-interest loans. This is in stark contrast to the past practice of focusing on high-credit borrowers.

As it became inevitable to revise lending strategies due to regulatory pressure, there is an analysis that banks are actively targeting medium-interest loans, which are outside the scope of regulations.

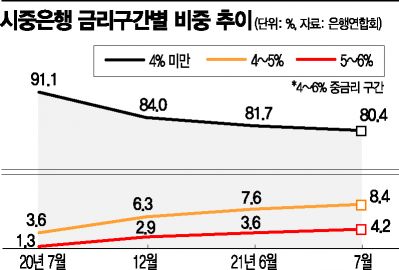

According to the Bankers Association on the 17th, the proportion of medium-interest credit loans (4~6%) from the four major commercial banks?KB Kookmin, Shinhan, Hana, and Woori?last month was 12.7%, up 1.5 percentage points from the previous month (11.2%). Compared to the 9% at the end of the year, it increased by 3.7 percentage points. Just a year ago, the proportion of medium-interest loans at the four banks was only 5.2%. In particular, loans in the 5~6% range expanded more than threefold from 1.3% to 4.25% during this period.

On the other hand, the proportion of high-credit borrower loans decreased rapidly. Last month, the share of credit loans with interest rates below 4% was 80.4%, down 1.3 percentage points in one month. In July last year, 91.1% of all credit loans handled were products for high-credit borrowers with interest rates below 4%.

The proportion of high-credit loans sharply decreases, while medium-credit loans rise significantly

This trend was most pronounced at Kookmin Bank. The proportion of credit loans below 4% at Kookmin Bank dropped from 89.5% a year ago to 71.3%, the lowest among the four. It was followed by ▲Hana Bank (79.8%) ▲Shinhan Bank (81.4%) ▲Woori Bank (89.2%). During the same period, Kookmin Bank’s medium-interest loan proportion surged from 7.3% to 20.9%. This is about twice the 10.8% of Shinhan Bank, which ranked second. The steepest increase was at Shinhan Bank, rising from 3.5% to 10.8%.

This behavior by banks contrasts with the usual practice of maintaining high-credit borrower loans even during economic downturns or when risk management is urgent. When the real economy worsened and delinquency rates began to rise in early 2019, commercial banks first reduced medium-interest loans. At that time, the proportion of medium-interest loans decreased by 2~3% across interest rate brackets.

The change in commercial banks’ lending strategies is due to the financial authorities’ debt management stance. The financial authorities see the cause of the rapid rise in household debt as the ‘debt investment’ (borrowing to invest) by high-credit borrowers. At the end of last year, some banks attempted to create products that lent up to 2.7 times the annual salary to professionals, but these were blocked by the financial authorities.

Accordingly, the financial sector has been reducing the limits on loan products for professionals, who are considered high-income earners. On the 10th, Shinhan Bank lowered the loan limit for its professional-exclusive loan product from a maximum of 200 million won to 100% of annual income. At the beginning of the year, Hana Bank also reduced the basic limits of its ‘Doctor Club Loan’ for doctors and oriental medicine doctors and ‘Lawyer Club Loan’ for lawyers from 150 million won to 50 million won.

A representative from a commercial bank explained, “Due to the increase in speculative demand, we had no choice but to uniformly reduce the annual income limits to reduce household debt,” adding, “As a result, loans to high-income earners with high salaries naturally decreased.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.