Q2 US Debt Increases by $490 Billion... China’s Debt Rises by $2.3 Trillion

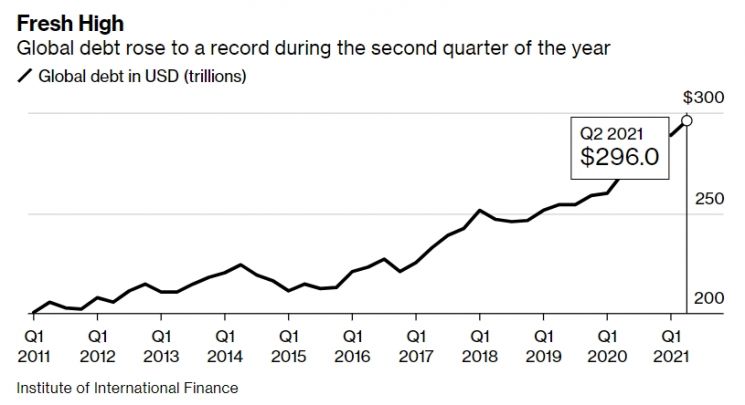

[Asia Economy Reporter Park Byung-hee] Global debt is likely to surpass $300 trillion within this year.

According to the International Institute of Finance (IIF), global debt increased by $4.8 trillion (approximately 5,626 trillion KRW) in the second quarter of this year, reaching $296 trillion, Bloomberg reported on the 14th (local time). If the current upward trend continues, it will exceed $300 trillion in the third quarter. Global debt slightly decreased in the first quarter of this year but returned to an increasing trend in the second quarter. Current debt is $36 trillion higher than before the COVID-19 pandemic.

Among the three economic sectors, household debt has increased the most, and debt growth in emerging countries is steeper than in advanced countries.

The IIF stated that household debt increased by $1.5 trillion in the first half of the year. During the same period, government debt rose by $1.3 trillion, and corporate debt increased by $1.2 trillion.

As the difference in vaccination rates between advanced and developing countries has become an international issue, the speed of debt increase shows a marked difference between these groups.

U.S. debt increased by $490 billion in the second quarter, the smallest increase since the COVID-19 pandemic began. In contrast, China's debt rose by $2.3 trillion in the second quarter, bringing its total debt to $55 trillion. The IIF pointed out that China's debt is increasing faster than any other country.

Excluding China, emerging market debt also approached $36 trillion, reaching an all-time high. The IIF explained that government debt in Brazil, Korea, and Russia increased significantly.

Including China, emerging market debt increased by $3.5 trillion in the second quarter, with the cumulative amount nearing $92 trillion.

However, even in the U.S., household debt increased at a record pace. The IIF explained that household debt in the U.S., China, and Brazil rose significantly due to increased home purchases financed by loans taking advantage of low interest rates and expanded spending following the lifting of lockdown measures.

The global debt-to-GDP ratio decreased for the first time since the COVID-19 pandemic. In the second quarter, the global debt-to-GDP ratio was about 353%, down 9 percentage points from the record high in the first quarter of this year. This was thanks to rapid economic recovery as vaccine distribution increased and lockdown measures eased. The IIF reported that due to strong economic rebounds, 51 out of 61 surveyed countries saw a decrease in their debt-to-GDP ratios.

However, Emre Tiftik, an IIF director who authored the report, assessed that "in most countries, economic growth is not sufficient to reduce the debt-to-GDP ratio to pre-COVID-19 levels." The countries that managed to lower their debt-to-GDP ratios to pre-pandemic levels were Mexico, Argentina, Denmark, Ireland, and Lebanon.

The issuance volume of bonds for sustainable investment this year was estimated at about $800 billion. This already surpassed last year's annual issuance, and the IIF expects the issuance volume to reach $1.2 trillion this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)