[Asia Economy Reporter Donghyun Choi] An analysis has emerged that for Korean online travel platforms (OTA) to survive in the global online travel market, an appropriate level of technology, focus on target markets, and market differentiation are key factors.

The Korea Tourism Organization announced on the 15th that this conclusion was drawn after analyzing the global travel market and the domestic industry status using domestic and international data. The Tourism Organization released a report titled "Next Level of the Travel Industry" containing this analysis on the same day.

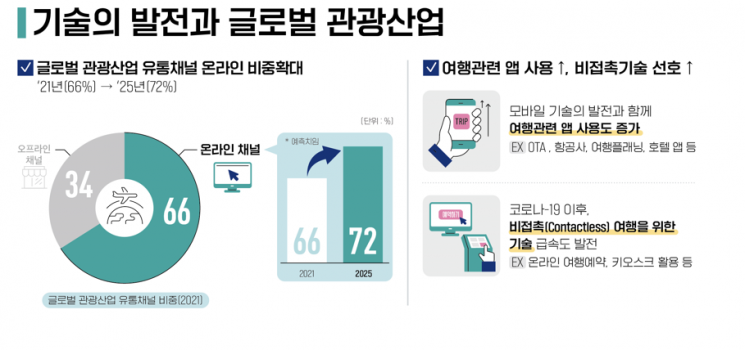

According to the report, the share of 'online distribution channels' in the global tourism industry is expected to expand from 60% in 2017 to 72% by 2025. The increase in the ‘platform’ market, which intermediates travel products and services, is expected to have the greatest impact. The 'online travel reservation platform market' is anticipated to grow rapidly by 89.8% compared to last year by 2027.

As the use of technology in the tourism industry accelerates, especially after COVID-19, demand for contactless technology has increased, leading to a rise in the use of mobile travel apps. Additionally, travel behaviors minimizing contact with others through contactless travel reservations have emerged, further promoting changes in consumers' travel methods. Among travel-related apps, ‘travel planning’ showed the highest increase rate, with usage rising from 27% before and after COVID-19 to 35%, an 8 percentage point increase.

Global OTAs are continuously growing larger through mergers and acquisitions of promising small and medium OTAs. As of last year, four OTA groups (Expedia, Booking Holdings, Trip.com, Airbnb) have grown to dominate 97% of the online travel market. Domestic OTAs, facing the COVID-19 crisis and fierce competition with global large OTAs, have expanded reservation services into various fields such as accommodation, airlines, and travel products. The transition of traditional travel agencies to OTAs and the transformation of tourism venture companies into travel tech companies are also progressing more rapidly.

Domestic users who have experienced OTAs generally gave positive evaluations of Korean OTAs compared to global OTAs in terms of ‘customer service,’ ‘web/app usability,’ and ‘mileage and points.’ However, there were shortcomings in terms of ‘value for price’ and ‘product diversity.’

The conclusion is that Korean OTAs should avoid simply following large global OTAs to secure competitiveness. The report pointed out that they should strengthen travel tech sectors such as customer service and ease of use of web or apps, which consumers consider strengths, targeting domestic and international travel markets for Koreans. It also suggested that securing price competitiveness and product diversity is necessary to strengthen competitiveness in the internal market and gain a differentiated advantage in competition with global OTAs.

From a policy perspective, it was also mentioned that institutional measures should be prepared to prevent excessive monopolization by global OTAs to ensure sustainable growth. It emphasized the need to steadily expand support for the use of travel tech, where domestic OTAs have strong competitiveness.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.