Living-Type Accommodation Facilities, Competition Rates Soar to Thousands to One

Lower Regulatory Barriers Compared to Apartments Attract Demand

No Penalties for Winning Cancellation, Leading to 'Blind Subscription'

"If I just click a few times at home and win, it's equivalent to my husband's annual salary. There's no reason not to do it."

A, who has been married for 9 years and is 39 years old, reaches for her smartphone first thing at 7 a.m. to check KakaoTalk chat rooms where real estate-related articles and information about subscription and real estate investment are posted. She is currently in 11 KakaoTalk rooms. The investment destination she has been paying close attention to recently is 'living-type lodging facilities (Saengsuk).' She has recently been using all family members' names to apply for Saengsuk subscriptions. Her strategy is to receive 'chopi' (pre-contract resale rights) if she wins and then exit quickly.

The real estate investment fever for non-residential products such as Saengsuk, officetels, and knowledge industry centers is escalating beyond overheating to a frenzy. As loan and tax regulations on existing housing such as apartments have been strengthened, demand is pouring into areas without such regulations.

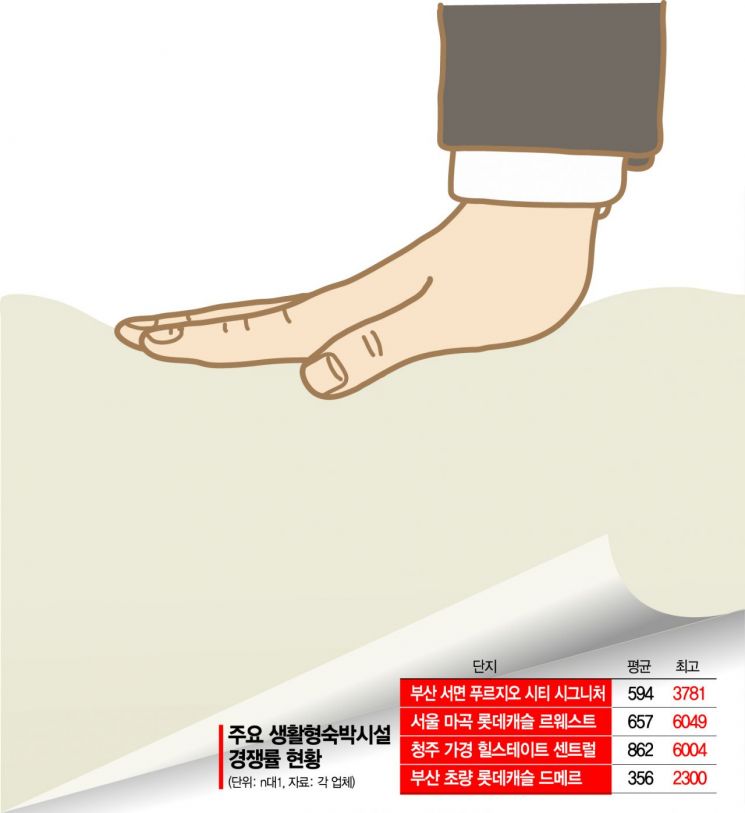

According to the industry on the 13th, Saengsuk units recently offered nationwide have been recording triple-digit average competition rates one after another. The Saengsuk 'Lotte Castle Le West' in Magok District, Gangseo-gu, Seoul, which was offered last month, attracted 575,950 subscription applications for 876 units, recording an average competition rate of 657 to 1. Some types saw competition rates soar to as high as 6,000 to 1. Considering that the sale price for an 84㎡ (exclusive area) unit was up to 1.61 billion KRW, comparable to the surrounding apartment market price, this is an abnormal phenomenon.

One reason for such high competition rates is that, unlike apartments, subscriptions can be made on an individual basis rather than by household. In fact, A used a total of six names for subscription to this complex. She, her husband, parents, and parents-in-law all participated in the subscription. Last year, A earned 40 million KRW in profit through officetel chopi investment in Songdo. She said, "This time, the location is so good that even if I don't get greedy and just receive chopi and sell, I am confident I can make tens of millions of won," adding, "I just regret that I don't have more names to use."

In fact, after the announcement of winners for this complex, premiums ranged from as low as 20 million KRW to as high as 150 million KRW depending on the unit size. In front of the model house, brokerage offices, known as 'tteotdabang' (fly-by-night brokers), appeared to mediate the sale of subscription rights. On online communities, posts such as "Looking to buy subscription rights for XXX KRW" are continuously being posted.

The chopi frenzy is not limited to Seoul. The Saengsuk 'Seomyeon Prugio City Signature' in Bujeon-dong, Busanjin-gu, Busan, which received subscriptions earlier this month, recorded an average competition rate of 594 to 1 and a maximum of 3,781 to 1. Originally, applications were to be accepted over two days from the 7th to the 8th, but due to server crashes caused by a flood of access and mounting complaints, the application period was extended by one day. Earlier in July, 'Hillstate Cheongju Central' in Heungdeok-gu, Cheongju, which offered 160 units, received about 138,000 subscription applications, recording an average competition rate of 862 to 1.

Seo Jin-hyung, president of the Korea Real Estate Society and professor at Gyeongin Women's University, said, "The Saengsuk frenzy is a balloon effect caused by regulations on apartments," adding, "As investment destinations disappear due to regulations, investment demand is pouring into niche products to receive chopi and exit quickly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)