Authorities Strictly Enforce Financial Consumer Protection Act

Companies Call for "Clear Interpretation"

[Asia Economy Reporter Kiho Sung] Fintech companies are on edge as financial authorities have announced their intention to strictly apply the Financial Consumer Protection Act (FCPA) to financial platforms. In particular, sanctions are expected to be imposed for violations of the law after the grace period for the FCPA ends on the 24th, but there is a need for clear interpretation due to ambiguous guidelines from the authorities.

According to the financial sector on the 13th, Kakao Pay has decided to operate its direct automobile insurance premium comparison service only until the 24th. Kakao Pay has been running the automobile insurance premium comparison and subscription service through its subsidiary KP Insurance Service (formerly Inbyu), partnering with six insurance companies including Hyundai Marine & Fire Insurance, DB Insurance, KB Insurance, Hana Insurance, AXA Insurance, and Carrot Insurance. After the service is discontinued, the partnership will be maintained only in the form of banner advertisements. Fund sales are also expected to be suspended after the 24th for similar reasons. Kakao Pay is currently selling a total of seven types of funds.

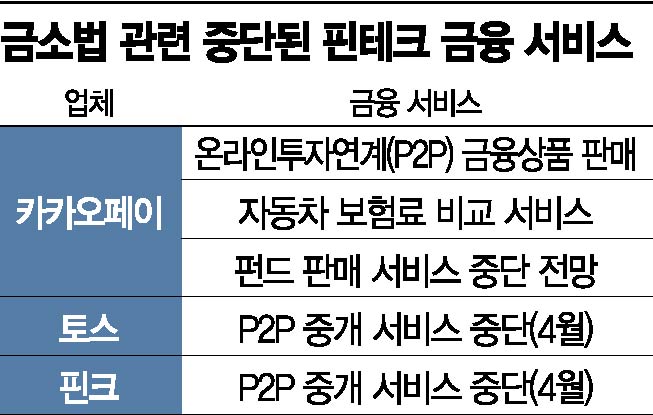

Fintech companies have been discontinuing related services one after another as financial authorities set a policy to strengthen the FCPA. Last month, Kakao Pay and Bank Salad ended their peer-to-peer (P2P) financial product sales services, and in April of this year, Toss and Finda also withdrew their P2P services respectively.

This situation arose because the financial authorities recently judged fintech companies’ product comparison and recommendation services as ‘intermediation’ rather than ‘advertising.’ After the FCPA guidance period ends, fintech companies must register as financial product sales agents or intermediaries with the Financial Services Commission (FSC) to compare and recommend financial products. However, in the case of fund intermediation, registration as an investment solicitation agent under the Capital Markets Act is only allowed for individuals, so fintech companies as corporations cannot register as investment product intermediaries. In the case of insurance intermediation, registration as an insurance agency is required, but the Enforcement Decree of the Insurance Business Act prohibits registration for institutions subject to FSC inspection, including electronic financial operators. The financial authorities plan to allow online platforms to register as insurance agencies but are still reviewing the matter.

Fintech companies argue that since there is no way to obtain a license, precise guidelines are needed for each product. For example, if Platform A provides a service recommending insurance products but links to the individual financial company’s website rather than concluding the insurance contract on the same screen, it is ambiguous whether this situation is illegal. Because of this, some fintech companies have inquired about specific guidelines from the Financial Services Commission.

The Fintech Industry Association is collecting various operational methods of financial product recommendation services by company. An industry official emphasized, "There are about 340 member companies registered with the Fintech Association," and added, "Since the situations are all different, more detailed guidelines are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.