Financial Supervisory Service "Reviewing Request for Amendment of Securities Registration Statement"

KakaoPay "Financial Service Guidance Phrase"...Criticized for Complacent Response

[Asia Economy Reporters Ji Yeon-jin, Hwang Jun-ho] KakaoPay's planned stock market debut next month has been delayed once again. Financial authorities recently judged that the investment and insurance services on online financial platforms violate the Financial Consumer Protection Act (FCPA), making disruptions to the listing schedule inevitable.

A Financial Supervisory Service (FSS) official said in a phone interview with Asia Economy on the 10th, "Based on the Financial Services Commission's (FSC) pointed issues, we will examine whether there are any inconsistencies with the contents stated in the securities registration statement," adding, "Since there are reports that some of KakaoPay's services may be unable to operate, we are verifying the facts."

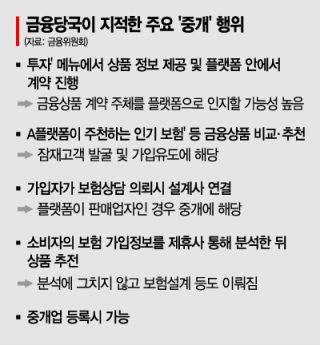

The FSC recently announced that if the financial product recommendation and comparison services operated by online platforms such as KakaoPay, which were presented as 'advertisements,' are deemed to be 'intermediation,' they would violate the FCPA effective from the 25th of this month. For example, if the first screen displays 'payment, loans, insurance,' along with 'investment' as provided services, consumers are likely to perceive the platform as the contracting party for financial products. Since this constitutes 'intermediation,' operating without the relevant business registration is prohibited. The FSS insists that any such FCPA violations must be reflected in the securities registration statement to protect investors.

KakaoPay postponed its listing schedule once after receiving a request to amend its securities registration statement from the FSS in July. KakaoPay submitted a revised registration statement last month. According to this, KakaoPay plans to conduct demand forecasting on the 29th of this month, followed by public subscription for shares on the 5th and 6th of next month. The effectiveness of this registration statement takes effect from the 25th of this month, but if the FSS requests another amendment before then, the listing schedule will inevitably be delayed.

If KakaoPay's financial services (funds, loans, insurance) are blocked due to the FSC's measures, KakaoPay's revenue is expected to decrease by nearly one-third. As of the first half of this year, these services accounted for about 32% (69.5 billion KRW) of total revenue. If major revenue sources are blocked, revisions to the expected revenue and the public offering price stated in the securities registration statement will also be necessary.

Moreover, KakaoPay plans to respond only by adding related disclaimers despite the authorities' firm stance, making it unlikely to meet the authorities' requirements. KakaoPay stated, "We understand that the authorities are not intending to suspend the services, so there are no changes to the listing promotion or service plans," adding, "In accordance with the FSC's explanation, we plan to handle this by including disclaimers such as 'You will be redirected to KakaoPay Securities' or 'This service is provided by a subsidiary' when moving to the relevant pages."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.