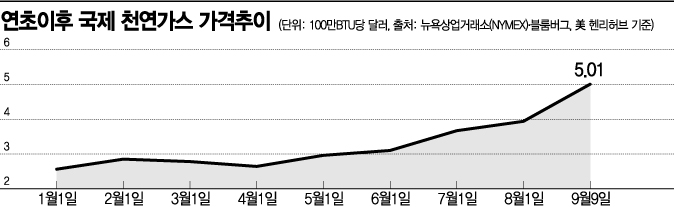

Already Doubled Since Early Year... Cold Wave Concerns Overlap

Eco-friendly and Nuclear Phase-out Trends Increase Power Generation Share

Domestic City Gas and Electricity Price Hike Pressure Likely to Grow

[Asia Economy Reporters Jusangdon and Hyunwoo Lee] Since the beginning of the year, international natural gas prices have already doubled, and with supply and demand concerns ahead of the winter season, there are growing fears that the rapid price surge will continue. Some predict that considering this winter's severe cold and various climate anomalies, prices could rise more than twice the current level. In particular, there are concerns that domestic city gas prices and electricity rates will face simultaneous upward pressure.

On the 9th (local time), natural gas futures on the New York Mercantile Exchange (NYMEX) closed at $5.01 per million BTU (British Thermal Units). This is the first time since February 2014 that natural gas prices have surpassed the $5 mark. Compared to $2.56 at the beginning of the year, natural gas prices have already nearly doubled.

Prices Soar Amid Climate Anomalies and Winter Cold Concerns

The biggest factor driving up natural gas prices is the climate anomalies occurring worldwide this year. Due to global warming effects, prolonged heatwaves have caused the price of natural gas, a key raw material for major refrigerants, to surge past the $3 mark starting in early June, the beginning of early summer.

Climate anomalies have also affected natural gas supply and demand. Earlier this month, Hurricane Ida struck the Gulf of Mexico, where major natural gas production facilities are concentrated, triggering a supply emergency. According to CNBC, about 78% of natural gas production plants in the Gulf of Mexico remain shut down.

Increased demand due to countries' eco-friendly policies has also fueled price rises. This is attributed to restrictions on coal-fired power generation under carbon neutrality policies in the United States and the European Union (EU). CNBC noted, "Due to droughts and floods caused by climate anomalies this year, solar and hydropower generation have decreased, increasing the share of natural gas power generation," and predicted, "Natural gas power generation will maintain a high share of around 30% for some time in the US, Europe, and other countries."

Under the green and nuclear phase-out policies, natural gas demand has also increased in East Asian countries. According to the US Energy Information Administration (EIA) data, in the first half of this year, Asian countries such as South Korea (13.4%), Japan (12.5%), and China (12.4%) ranked among the top importers of US natural gas.

Concerns have even arisen that prices could more than double compared to current levels due to expected severe cold from climate anomalies this winter. Goldman Sachs warned in a report released that day, "Due to the surge in refrigerant gas use during this summer's heatwave, winter fuel natural gas reserves have significantly decreased, and if the cold intensifies, gas prices could soar above $10, more than twice the current level."

Concerns Over Simultaneous Increases in Domestic City Gas and Electricity Rates

As spot prices rise, the possibility of domestic price increases has also grown. This is because more than half of liquefied natural gas (LNG) in South Korea is supplied as city gas for residential heating and other uses. According to Korea Gas Corporation, last year, domestic LNG sales totaled 32.367 million tons, of which city gas used for residential heating and industrial purposes accounted for 56.4% of total sales. The remaining half was sold for LNG power generation.

In particular, residential and general city gas rates have been frozen for 15 months since July last year, increasing upward pressure. A government official stated, "Gas prices are supplied through medium- to long-term contracts of 5 to 10 years, so there will be no direct impact," but added, "For power generation, under the fuel cost linkage system, the rise in LNG prices is likely to pressure electricity rate increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.