The heads of 15 major domestic conglomerates have united to form the K-Hydrogen Alliance. They plan to invest a staggering 43.4 trillion KRW by 2030 to develop the hydrogen industry. The alliance will promote cooperation among companies in the hydrogen sector and propose policies to the government, playing a consultative role in leading the hydrogen economy. This alliance is expected to invigorate hydrogen-related industries such as automotive, petrochemicals, and materials. Stock prices of hydrogen-related companies are also fluctuating, with material companies experiencing particularly sharp increases. Reflecting market interest, Asia Economy examines the current status and growth potential of Hyosung Advanced Materials, which produces the core material of hydrogen tanks, carbon fiber, and Kolon Industries, which manufactures hydrogen car parts and materials.

[Asia Economy Reporter Lim Jeong-su] Hyosung Advanced Materials has gained growth momentum through the domestic conglomerates' hydrogen alliance. Carbon fiber, which is ten times stronger than steel and weighs only a quarter as much, is used as a core material in hydrogen tanks and other hydrogen economy applications. Hyosung Advanced Materials' carbon fiber, developed with Korea's first independent technology, is seeing rapidly increasing demand due to the expansion of the hydrogen industry ecosystem. Additionally, aramid fiber, which boasts outstanding technological capabilities, is increasingly used in future industries such as 5G communications, electric vehicles, and high-performance tires. Alongside stable growth in its main tire cord business, carbon fiber and aramid fiber are expected to serve as key growth drivers.

◇ Successful Localization of Carbon Fiber Previously Dependent on Japan, Increasing Global Market Share = The carbon fiber industry, used as a core material in industries requiring lightweight materials such as passenger cars, aircraft structures, aerospace, medical devices, and clothing, has long been dominated by Japanese companies. The Japanese Big 3?Toray (40%), Toho Tenax (12%), and Mitsubishi Chemical (12%)?control over 70% of the global market. They are followed by U.S. company Hexcel (8%), Taiwanese company Formosa Plastics (7%), and German company SGL (7%). The entry barrier is high, with only a few countries succeeding in development.

Hyosung Advanced Materials became the fourth in the world to develop carbon fiber in 2011, following Japan, Germany, and the U.S. Recently, due to increased orders from domestic and international companies, its global market share has risen to around 3%. Intermediate goods producers such as SK Chemical, Korea Carbon, Hyundai Hi-Vac, JMC, and Korea New Materials, which previously depended on Japanese companies, are increasing orders from Hyosung Advanced Materials, reducing reliance on Japan and accelerating Hyosung’s market share growth.

Hyosung Advanced Materials is also expanding production capacity to meet growing demand. With a flood of orders, including large-scale long-term supply contracts with Samaron, acquired by Hanwha Solutions, Iljin Hi-Solus, recently listed, and NK, expansion has become necessary. Currently, it has an annual production capacity of 4,000 tons, with an additional 2,500 tons planned for next year. Production is expected to increase to 10,000 tons in 2024 and 24,000 tons by 2030 when expansion is completed.

Hanseongwon, an analyst at Daishin Securities, forecasted, "Because carbon fiber has high added value, profitability will improve faster as production volume increases." He added, "Although the carbon fiber business currently has a minimal impact on Hyosung Advanced Materials' corporate value, considering expansions, it is estimated to be worth about 700 billion KRW."

◇ Aramid Fiber Also Gains Growth Momentum... Stable Growth in Tire Cord = Aramid fiber is another pillar of growth. It is a new material with high strength and heat resistance, used in high-performance tires, bulletproof vests, and special hoses. Demand is increasing as it is used in optical cables for 5G networks, internal reinforcements for vehicle lightweighting, and tire reinforcement materials.

Hyosung Advanced Materials developed aramid fiber with proprietary technology in 2003 and successfully commercialized it in 2009. Since last year, it has invested to expand aramid production facilities in Ulsan, completing expansion in the first half of this year. This expansion increased Ulsan plant’s production capacity from 1,200 tons to about 3,700 tons, nearly tripling output.

The tire cord segment, the company’s main business, continues to show stable growth. This year, demand for replacement tires (RE) recovered, leading to improved performance. As manufacturers could not keep up with rising demand, tire cord prices also increased. According to the tire industry, tire cord prices rose about 15% in the second quarter of this year.

Demand for tires for new cars is also expected to increase in the second half of the year. New car sales, which had declined due to semiconductor shortages, have begun to rebound as semiconductor supply improves, leading to a recovery in demand for tires and tire cords.

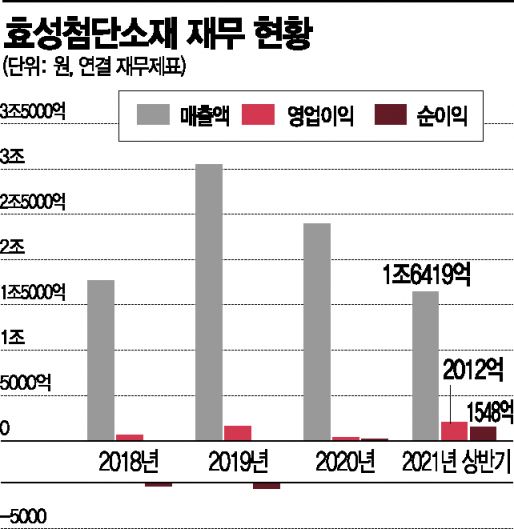

Hyosung Advanced Materials’ earnings forecasts also indicate steep growth. According to consensus estimates from domestic securities firms, the company’s consolidated annual sales for 2023 are expected to reach 3.7 trillion KRW, with operating profit increasing to 428 billion KRW. Compared to last year’s annual results, sales are projected to increase by more than 1.3 trillion KRW, and operating profit is expected to grow more than tenfold.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.