[Asia Economy Reporter Kim Jin-ho] The financial authorities have drawn a line by emphasizing the basic principles considering consumer protection and fairness in the regulatory controversy related to online financial platforms.

The Financial Services Commission (FSC) announced that it held a working-level meeting with the Korea Fintech Industry Association and major fintech companies at 2 p.m. on the 9th to convey this position. The meeting was arranged to explain guidelines related to the application of the Financial Consumer Protection Act to online financial platforms.

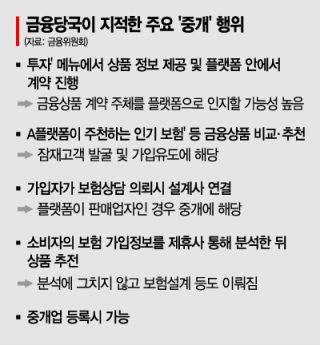

Previously, the financial authorities judged that online financial platform services are not simple advertisements but 'sales brokerage,' which led to controversies over violations of the Financial Consumer Protection Act involving representative fintech companies such as KakaoPay and Toss.

However, the FSC stated that the application of the Financial Consumer Protection Act is not intended to restrict the business of specific online financial platforms but to present basic principles related to the sale of online financial products. It explained that the criteria for determining whether an act constitutes 'brokerage' under the Financial Consumer Protection Act, which had been informed from the field around the time of the Act's enforcement, were further specified with examples.

The FSC also conveyed the meaning that even while pursuing innovation, efforts should be made together to protect financial consumers and maintain a sound market order rather than receiving exceptions from financial regulations or supervision.

However, it added that it would carefully review the inquiries and difficulties heard from the fintech industry. It will actively support parts where the application of the system is difficult, but will comprehensively consider consumer protection aspects and fairness with other companies regarding difficulties.

An FSC official said, "We will continue efforts to ensure that the Financial Consumer Protection Act is promptly established in the field," and "If there is a possibility of illegality but no voluntary corrective efforts, we will respond strictly."

Meanwhile, Hong Seong-gi, Director of the Financial Consumer Policy Division at the FSC, who presided over the meeting, explained in a briefing, "It is not problematic that financial companies provide services simply through one app via platform firms," and added, "We need to review the specific details of how financial products are linked to sales activities and services through one app to make a judgment." He further stated, "If it is a role of providing information that connects financial product providers rather than simply brokering financial products, there should be no particular problem."

Regarding specific conditions to avoid brokerage when platform companies recommend and compare financial products, he responded, "If companies first present specific methods they intend to supplement, we will collect and review them before responding."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.