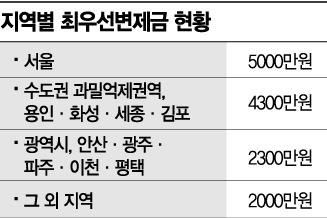

Priority Repayment Amount: 50 Million KRW in Seoul, 43 Million KRW in the Metropolitan Area

Average Jeonse Price for Seoul Basement Villas Also Exceeds 100 Million KRW

Unrealistic High-Value Housing Standards... Comprehensive Real Estate Tax and Loans Vary

Although housing prices are soaring to unprecedented levels, the priority repayment amount to protect small-scale tenants and the high-priced housing standard amount fall short of reality, prompting urgent calls for improvement. Since these benchmarks significantly impact the overall real estate market?including loan limits, tenant priority dividends, rental business guarantee insurance, and brokerage fees?they need to be updated to reflect current market conditions.

According to the Ministry of Land, Infrastructure and Transport and the real estate industry on the 9th, the current priority repayment amounts under the Housing Lease Protection Act are approximately 50 million won in Seoul, 43 million won in the metropolitan area’s overconcentration control zones, 23 million won in metropolitan cities, and 20 million won in other regions. The priority repayment amount refers to the right of small-scale tenants to receive dividends ahead of senior creditors when the landlord goes bankrupt and the deposit cannot be returned, and the property is auctioned. It serves as a minimum safety net to protect relatively vulnerable tenants.

Even Semi-basements Cost 100 Million Won... Tenant Protection Detached from Reality

The government adjusted the priority repayment amount in Seoul from 37 million won in May 2018 to 50 million won this May. However, this is far too low considering the current rental deposit market prices. In fact, Station3, which operates the real estate platform Dabang, analyzed actual transaction data from the Ministry of Land and found that the average jeonse (long-term deposit lease) for small underground villas under 60㎡ (exclusive area) traded in Seoul from 2017 to last month reached 100.435 million won.

Because of this, the industry evaluates that almost no tenants can benefit from the priority repayment system except for those in aging multi-family or multi-unit houses in outlying areas. The head of a real estate agency in Yeongdeungpo-gu, Seoul, said, "Many people take out low-interest jeonse loans for small and medium enterprises, so even one-room jeonse prices have risen significantly in recent years," adding, "The current standard is somewhat low."

Recently, the Ministry of Land announced a standard to exempt rental business operators from subscribing to guarantee insurance for registered rental housing below the priority repayment amount, which has been criticized among operators as a "hollow and ineffective policy." Considering that even Dobong-gu, one of the cheapest rental areas in Seoul, has an average jeonse deposit of 70.89 million won, it is expected that very few operators will meet the "deposit under 50 million won" criterion.

Controversy Over High-Priced Housing Subject to Loan and Tax Surcharges

The high-priced housing standard is also controversial. Currently, 900 million won is commonly used as the benchmark for high-priced housing. Homes with a sale price above 900 million won cannot receive interim payment loans, and the highest acquisition tax rate (3.3%) applies. In regulated areas, the loan-to-value ratio (LTV) is 40% for properties up to 900 million won but is drastically reduced to 20% for those exceeding 900 million won. Property tax is also reduced by 0.05 percentage points for properties with a publicly announced price below 900 million won.

Since apartment prices have skyrocketed under the current government, there have been continuous calls to revise the high-priced housing standard to better reflect reality. According to the Korea Real Estate Board’s monthly housing price trends, the average apartment sale price in Seoul reached 1.1093 billion won in July. Although there is a difference between market price and publicly announced price, the standards for high-priced housing currently used by the government vary and are widely regarded as failing to reflect reality adequately.

As the ruling party and government recently proposed raising the comprehensive real estate tax threshold from the current 900 million won to 1.1 billion won and increasing the capital gains tax exemption threshold for single-homeowners from 900 million won to 1.2 billion won, concerns have been raised that the overall high-priced housing standards have become more complicated. For example, a property may not be considered high-priced under the comprehensive real estate tax but may be classified as such for local taxes, leading to inconsistent standards.

The Ministry of Land plans to raise the maximum brokerage commission rate applied to housing sales from 900 million won to 1.5 billion won starting next month. Previously, a uniform 0.9% rate was applied to transactions over 900 million won, but going forward, it will be segmented as 0.5% for 900 million to 1.2 billion won, 0.6% for 1.2 billion to 1.5 billion won, and 0.7% for amounts exceeding 1.5 billion won. For leases, the highest rate of 0.6% will only apply to properties priced above 1.5 billion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.