NH Securities, Korea Investment & Securities, Mirae Asset

KB Securities, Samsung Securities, Daishin Securities

In the e-commerce market listing competition

Speeding up with the goal of listing by the end of next year

Value increased after acquiring eBay Korea

[Asia Economy Reporter Park So-yeon] Six major domestic securities firms are expected to fiercely compete in bidding to be the lead underwriter for the listing of SSG.com, an e-commerce company under Shinsegae Group. SSG.com, whose listing corporate value is analyzed to reach up to 10 trillion KRW, aims to be listed on the KOSPI market by the end of next year.

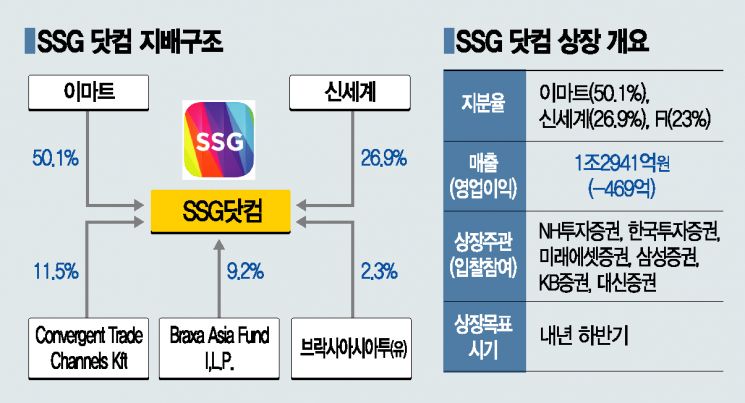

According to the investment banking (IB) industry on the 9th, after SSG.com distributed the Request for Proposal (RFP) for selecting the lead underwriter to major securities firms last month, six securities companies including NH Investment & Securities, Korea Investment & Securities, Mirae Asset Securities, KB Securities, Samsung Securities, and Daishin Securities participated in the bidding. The six securities firms have completed submitting their proposals and are scheduled to hold presentations next week. The participating securities firms are reported to highly evaluate SSG.com's business growth potential. The financial investment industry forecasts that SSG.com's corporate value will exceed 10 trillion KRW upon listing.

SSG.com, launched by a physical division of Emart's online business division, grew larger by absorbing Shinsegae Mall, which was separated from Shinsegae. Currently, SSG.com is a subsidiary of Emart, but both Emart (50.1%) and Shinsegae (26.9%) hold shares, making it the online distribution platform of Shinsegae Group.

In 2018, SSG.com received a total of 1 trillion KRW in new share acquisition investment commitments from private equity fund (PEF) operators Affinity Equity Partners and BlueRun Ventures, promising to go public by 2023. According to the shareholder agreement signed on March 27, 2019, if SSG.com fails to meet total sales or IPO requirements by the 2023 fiscal year, the private equity funds have the right to demand that major shareholders Shinsegae and Emart buy all their owned shares.

SSG.com has recently attracted market attention due to significantly improved performance and the changed financing atmosphere after acquiring eBay Korea, and has entered full-scale listing preparation procedures. Last year, it recorded sales of 1.2941 trillion KRW and an operating loss of 46.9 billion KRW, with sales increasing by more than 50% and losses nearly halved compared to 2019. Sales in the first half of this year also continued the growth trend, increasing by 11% year-on-year to 686.6 billion KRW.

The reason Shinsegae Group is accelerating SSG.com's listing ahead of the original plan is the intensified listing competition in the domestic e-commerce industry. Since Coupang's listing on the New York Stock Exchange in March this year, IPOs have been following one after another in the e-commerce sector. Market Kurly announced in July that it raised 225.4 billion KRW in Series F funding and plans to pursue a domestic stock market listing. Oasis Market is preparing for listing by selecting NH Investment & Securities and Korea Investment & Securities as lead underwriters. 11st also plans to go public by 2023. SK Telecom, the parent company of 11st, started operating the Amazon Global Store and stated, "We will conduct large-scale promotions and investments with Amazon and lay the groundwork for a successful 11st IPO."

A securities industry official said, "To take advantage of the recent attention on the e-commerce industry, Shinsegae Group internally set the target date for SSG.com's listing at the end of 2022," adding, "They will soon decide on the lead underwriter and enter full-scale listing preparation procedures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.