Non-Fungible Tokens (NFTs), Unique Certificates of Authenticity

Creating One-of-a-Kind Digital Files Increases Scarcity

Famous Figures Like Jack Dorsey and Damien Hirst Participate

'Stone Painting' Minimum Price 3.4 Billion KRW... "Just a Bubble" Skepticism

Experts: "Can't Dismiss as Bubble, But Seems Based on Short-Term Psychology"

"Young People with Income Instability Attracted to High-Risk Assets"

[Asia Economy Reporter Lim Juhyung] "A rock drawing sold for tens of billions of won?"

Recently, the news that the non-fungible token (NFT) asset 'EtherRock' was sold for 3 million dollars (about 3.4 billion won) has attracted the attention of netizens both domestically and internationally. NFT is a type of blockchain technology that grants an image file or photo an irreplaceable 'digital certificate,' making it a unique existence worldwide. Recently, many artists have entered the NFT market, and paintings, videos, and photos are being sold at high prices.

NFT investors claim that NFT assets have their own scarcity and collectible value. However, there are also skeptical views raising suspicions of speculation, questioning how a simple image file that anyone can easily mass-produce can reach tens of millions of won or more.

◆EtherRock, a rock drawing released as a limited edition of 100 pieces, worth at least 3 billion won

The 'rock drawing' EtherRock at the center of the controversy is the first collectible NFT issued by the cryptocurrency 'Ethereum.' According to the official Ethereum website, only 100 EtherRocks were produced, and investors can freely buy and sell them. However, it has no other functions. Ethereum claims that the value of this image file lies in "the pride of owning one of the 100."

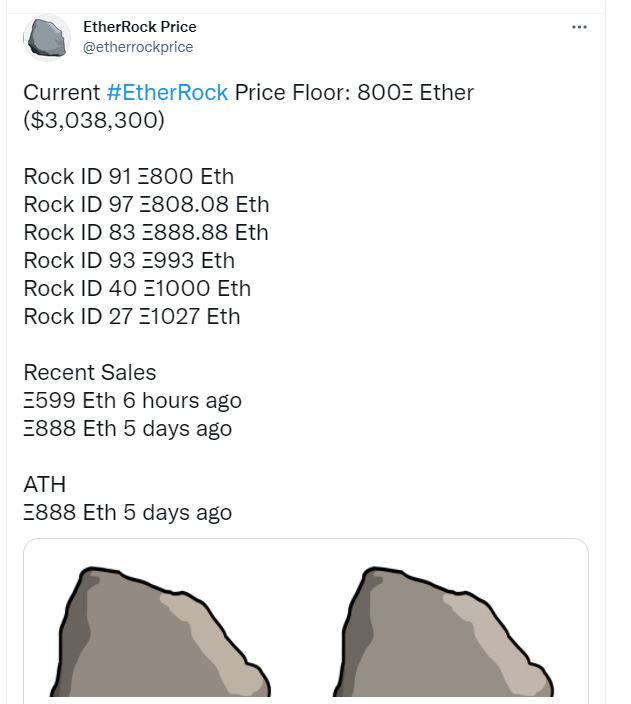

According to the Twitter account 'EtheRock Price,' which provides price information for EtheRock, the lowest price of EtheRock surpassed approximately 3.4 billion KRW as of the 3rd (local time). / Photo by Twitter capture

According to the Twitter account 'EtheRock Price,' which provides price information for EtheRock, the lowest price of EtheRock surpassed approximately 3.4 billion KRW as of the 3rd (local time). / Photo by Twitter capture

EtherRock attracted the attention of many investors as soon as it was released. According to 'EtherRock Price,' which provides EtherRock price information as of the 3rd (local time), the lowest EtherRock price reaches a total of 800 Ethereum, or 3 million dollars (about 3.4 billion won).

EtherRock's dazzling success has fueled the domestic and international NFT 'speculation controversy.' A domestic netizen said, "That rock drawing, which looks like it was roughly drawn with Paint, is more expensive than a luxury apartment in Seoul. Are you kidding me?" and expressed frustration, saying, "If this is not a speculative frenzy, then what is it?"

Overseas, self-deprecating comments about the NFT craze continue. Netizens sarcastically responded, "This can't be real," and "I'll make 'EtherJewel' instead of EtherRock. Then I could become a billionaire."

◆From Jack Dorsey to Damien Hirst... 'NFT Frenzy'

NFT technology is estimated to have been developed in 2012. At that time, some developers researching blockchain foresaw that real assets like real estate could be implemented in virtual digital spaces by transferring non-fungible digital certificates.

NFTs are currently gaining popularity in the art market. After selecting a work to be NFT-ized, the work is registered on an exchange, and when a transaction occurs, the seller receives money in the form of Ethereum in their digital wallet.

In 2017, a company called 'CryptoPunks' sold the world's first NFT-ized rare digital artwork. Since then, as celebrities gradually participated in NFT sales, the market has rapidly expanded. Twitter founder Jack Dorsey's photo of his first tweet was sold for a whopping 3.2 billion won.

Tim Berners-Lee, the British computer scientist who created the World Wide Web (WWW), declared he would auction the original source code of the WWW as an NFT. Meanwhile, modern art master Damien Hirst and British 'street artist' Banksy are also known to have started producing NFTs, attracting attention.

Eight cherry blossom paintings sold by British contemporary artist Damien Hirst using cryptocurrencies such as Bitcoin. / Photo by Damien Hirst

Eight cherry blossom paintings sold by British contemporary artist Damien Hirst using cryptocurrencies such as Bitcoin. / Photo by Damien Hirst

NFT has also changed the landscape of the domestic art market. Since artist Mari Kim sold the first NFT-ized artwork in Korea for 600 million won last March, NFTs have been gaining popularity in the domestic art market as well.

Not only celebrities but also unknown artists, professional investors, and ordinary people are participating in NFTs. On social media platforms like Twitter and Facebook, it is easy to find people buying and selling NFT images they created themselves.

◆"Contributing to the popularization of art" vs. "Will plummet in value once the hype cools"

Opinions among citizens regarding the 'NFT frenzy' are divided. Some view it as an innovation that opened the art market to the public, while others are skeptical, seeing it as just another bubble.

A 29-year-old office worker A, who majored in art history in college, said, "High-priced art auctions are something ordinary people can't even dream of. On the other hand, NFT artworks have a wide range of prices and types. If this isn't the 'popularization of art,' then what is?" He added, "Some argue that aside from being image files, NFTs are useless, but isn't that the same for other artworks? In fact, I believe NFTs have much higher value than traditional artworks, which are constantly embroiled in forgery controversies."

On the other hand, there are criticisms that the value is unstable and there is no means to guarantee it. A 31-year-old office worker B said, "I became interested in NFTs and looked up how to trade them, but if you buy an image file and can't find someone to resell it to, you end up bearing the cost yourself." He pointed out, "The only reason NFTs have value is scarcity, but honestly, once the bubble bursts, they will quickly become worthless. What will happen to NFT files that can't be disposed of by then?"

Experts explain that groups with limited asset accumulation options may find high-risk, high-return asset investments like NFTs attractive.

Professor Kim Taegi of Dankook University's Department of Economics said, "Virtual assets like NFTs are especially popular among young people because income is unstable due to factors like a cooling job market." He analyzed, "They know that the value of virtual assets is hard to determine clearly and that they are high-risk, but they can't help but find them attractive."

He added, "NFTs cannot simply be dismissed as a bubble. The principle of scarcity is at work, and the current NFT market is driven more by short-term psychological states than market principles." He explained, "Those investing in NFTs also have their own reasons for seeing NFTs as an attractive investment vehicle."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.