Weight on Additional Interest Rate Hike Within the Year

Efforts to Issue Subordinated Bonds

But Interest Expense Burden May Increase

[Asia Economy Reporter Oh Hyung-gil] Concerns are rising that insurance companies' capital could decrease by nearly tens of trillions of won as expectations grow for additional interest rate hikes within the year following last month's rate increase.

Most insurance companies are currently issuing subordinated bonds to raise capital immediately, but this could become a greater burden in the future, making it difficult to serve as a fundamental solution.

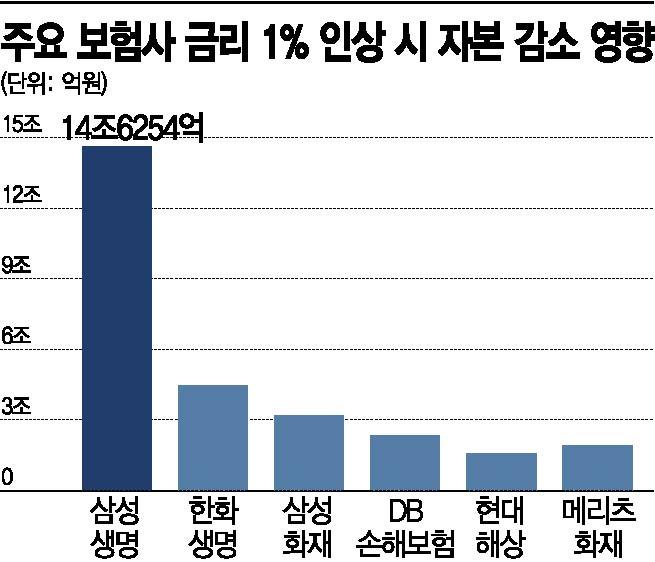

According to the insurance industry on the 6th, six major large life and non-life insurers (Samsung Life Insurance, Hanwha Life Insurance, Samsung Fire & Marine Insurance, DB Insurance, Hyundai Marine & Fire Insurance, Meritz Fire & Marine Insurance) estimated that a 1% increase in interest rates as of the end of last year would result in a capital reduction of 28 trillion won.

Samsung Life Insurance analyzed that if interest rates increase by 100 basis points (1bp=0.01%), its capital would decrease by 14.6254 trillion won. The impact of interest rates has grown compared to 2019, when a reduction of 12.2668 trillion won was expected. Hanwha Life Insurance also projected a capital decrease of 4.4782 trillion won in the event of an interest rate hike.

Among non-life insurers, Samsung Fire & Marine Insurance forecasted a capital decrease of 3.1681 trillion won. Following that, DB Insurance is expected to see a reduction of 2.3301 trillion won, Hyundai Marine & Fire Insurance 1.5752 trillion won, and Meritz Fire & Marine Insurance 1.9223 trillion won.

Insurance companies primarily manage assets by investing in bonds. Under current accounting standards, when interest rates rise, valuation losses on available-for-sale securities (bonds) occur, leading to a decrease in insurers' capital.

Insurance companies, which had classified held-to-maturity securities as available-for-sale securities to secure financial soundness by seeking bond valuation gains during the prolonged low-interest rate environment, are now concerned that valuation losses will expand further due to rising interest rates.

Status of Total Assets and Equity Capital of Insurance Companies in the First Half of 2021 (Source: Financial Supervisory Service)

Status of Total Assets and Equity Capital of Insurance Companies in the First Half of 2021 (Source: Financial Supervisory Service)

In reality, the reduction in insurance companies' capital is materializing. According to the Financial Supervisory Service, as of the first half of the year, total assets of insurance companies reached 1,331.831 trillion won, an increase of 0.8% from the end of last year, but their equity capital decreased by 5.3% to 135.6488 trillion won. This was due to a reduction in bond valuation gains as market interest rates rose, despite realizing better-than-expected net income.

Especially, the new International Financial Reporting Standard (IFRS 17), scheduled to be introduced in 2023, poses a risk of further deterioration in financial soundness. Under IFRS 17, insurance liabilities are measured at fair value rather than cost, requiring insurers to accumulate more capital.

Among these, available-for-sale securities are evaluated quarterly at market value and reflected in accounting. Insurers with a high proportion of available-for-sale securities are expected to reflect more bond valuation losses, leading to a further decline in their Risk-Based Capital (RBC) ratio. It is anticipated that the scale of capital expansion will need to increase beyond the current level.

Already, the scale of capital expansion by insurance companies this year has exceeded 2 trillion won, surpassing last year's level. This month, Kyobo Life Insurance plans to issue up to 500 billion won worth of hybrid capital securities (perpetual bonds), and in the second half of the year, KB Insurance may also issue subordinated bonds worth 400 billion won.

No Geon-yeop, a research fellow at the Korea Insurance Research Institute, pointed out, "At the end of last year, the operating asset yield of insurance companies was 3.1%, whereas the interest rates on recently issued subordinated bonds ranged from 3.3% to 4.8%, resulting in interest expenses higher than the operating asset yield," adding, "If the issuance of capital securities such as subordinated bonds increases, insurers will bear higher interest expenses due to rising interest rates, which will reduce profits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.