Financial Authorities' Priority Project Indefinitely Postponed Amid Conflict

Intense Battle for Dominance Between Banks and Big Tech for Survival

Experts Advise "Same Business, Same Regulation" as Solution

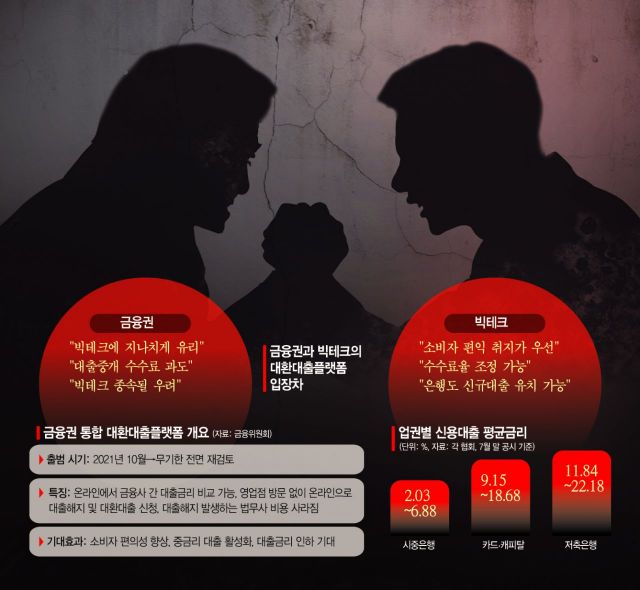

[Asia Economy Reporters Kim Jin-ho and Sung Ki-ho] As the financial lives of the public rapidly shift toward a ‘platform’ centered model, conflicts between traditional financial institutions and big tech (large information and communication companies) are intensifying. This is because their respective interests are sharply intertwined in the battle for dominance in the new financial environment. While the financial sector protests that excessive privileges are being granted only to big tech, big tech counters by accusing the financial sector of neglecting consumer benefits.

Amid rapid environmental changes and sharply conflicting interests, financial authorities also seem unable to maintain a firm stance. In particular, they are not free from criticism that they have caused conflict by unilaterally favoring big tech in the process of excessively emphasizing innovative finance. Experts advise that the solution lies in leaving the market to self-regulation while applying the principle of ‘same business, same regulation’.

◆ Financial Institutions VS Big Tech ? A Survival Battle for Dominance = As big tech and fintech companies expand their financial territories in all directions, the survival battle for dominance with traditional financial institutions is expressed in every issue. In the rapidly changing paradigm of the financial market, who takes the lead determines whether one will be subordinated or dominant.

The most controversial issue recently has been the refinancing loan platform. Initially, financial authorities planned to launch it on the 24th of next month. However, major commercial banks strongly opposed the service, fearing subordination to big tech if it were launched, while big tech companies emphasized its necessity for consumer benefits. Amid this tense standoff, the change in the head of the financial authorities shifted the atmosphere. On the 3rd, Go Seung-beom, the new chairman of the Financial Services Commission, told reporters, "The refinancing loan platform service is an issue that needs continuous review," adding, "We will not be bound by the reconsideration deadline and will negotiate sufficiently even if it takes time." In effect, the launch within this year has been canceled.

The refinancing loan platform is one of the key projects created by financial authorities with the aim of reducing the interest burden on ordinary citizens by making it easy to switch all household loans.

The refinancing loan platform is expected to have considerable ripple effects because it allows easy and simple refinancing. Since the scale of household loans reaches about 1,800 trillion won, fierce interest rate competition could enable financial institutions to steal ‘home customers’ from their competitors. All financial institutions inevitably enter ‘infinite competition’ to steal and retain customers.

However, the existing financial sector is reluctant to participate, citing that the platform’s dominance lies with big tech. There are concerns that it might degenerate into merely providing product procurement functions while offering high fees. A banking sector official said, "The bear (banks) will do the tricks, but the king’s husband (big tech) will take the money," pointing out, "We understand the financial authorities’ intention to introduce this, but the big tech-centered operation is excessive." On the other hand, big tech companies emphasize consumer benefits and rebut that the existing financial sector’s claims are excessive.

◆ Government Hesitant, Experts Say "Same Business, Same Regulation" Is the Solution = The government is just watching cautiously between the financial sector and big tech. While basically sympathizing with big tech’s position emphasizing consumer benefits, it cannot ignore the dissatisfaction of existing financial institutions. Otherwise, it could be seen as a demand to unilaterally hand over dominance to big tech in the new financial environment era.

In particular, over the past few years, the government has been criticized for ‘favoring big tech’ while pushing various policies under the banner of ‘innovative finance.’ Similar situations occurred before the refinancing loan platform, such as the amendment to the Electronic Financial Transactions Act and the MyData business.

Experts point out that as the digital financial era has fully begun, clashes between the two groups with different interests were inevitable, but financial authorities were unprepared. To prevent greater confusion, they say that the same regulations should be applied to the same businesses to fundamentally block so-called ‘privilege disputes.’

Professor Kim Sang-bong of Hansung University’s Department of Economics said, "In the case of the refinancing loan platform, the current system has a structure where so-called unfair trade issues can arise," adding, "To avoid such controversies, applying the same regulations to the same business is the right path."

Professor Lee Min-hwan of Inha University’s Department of Global Finance also said, "Big tech’s businesses are no different from financial businesses, but since they are not sufficiently regulated, existing financial institutions inevitably have concerns," adding, "If it is difficult to unify regulations for the two industries, at least the same regulations should be applied to the same business to protect consumers and minimize conflicts between companies."

He continued, "From the authorities’ perspective, the rapid changes in the financial environment pose difficulties, but it is necessary to simultaneously work on changing the framework for regulation and supervision to keep up with the flow of finance as soon as possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.