FKI Analyzes Performance of 30 Major Corporations Over 5 Years

Poor Results Due to Declining Local Demand and Intensified Competition

Urgent Need to Find New Growth Engines and Normalize Economic Cooperation

[Asia Economy Reporter Kim Hyewon] Major domestic conglomerates' businesses in China have been on a downward trend for several years. Sales, profit margins, and market share in the Chinese market are all declining, highlighting the urgent need to normalize Korea-China economic cooperation to find new business opportunities.

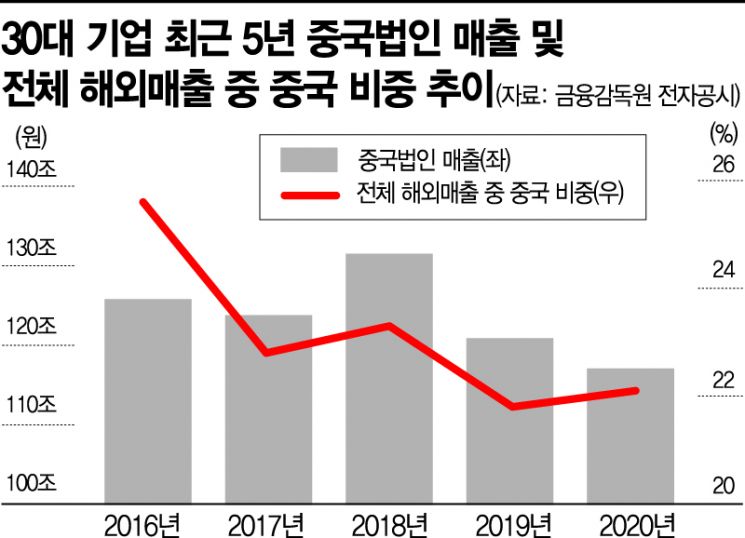

On the 6th, the Federation of Korean Industries (FKI) analyzed the management performance of Korean corporations investing in China since 2016. The China-related sales of 30 major conglomerates that disclosed their China performance amounted to 117.1 trillion KRW last year, a 6.9% decrease compared to 125.8 trillion KRW in 2016. During the same period, the proportion of China sales in the overseas sales of 30 major conglomerates, including Samsung Electronics and Hyundai Motor Company, dropped by 3.5 percentage points from 25.6% to 22.1%.

The Export-Import Bank of Korea estimates that the total number of Chinese subsidiaries of domestic companies is 1,566. The sales of these subsidiaries have been declining since peaking in 2013 at $250.2 billion (approximately 261 trillion KRW). Operating profit margins decreased by 2.5 percentage points from 4.6% in 2016 to 2.1% in 2019.

The FKI cited decreased local demand and intensified competition as causes of the poor performance. The THAAD (Terminal High Altitude Area Defense) conflict in 2016-2017 and the U.S.-China trade dispute in 2018, which led to reduced semiconductor demand from Chinese companies such as Huawei, negatively impacted the market. In particular, Korean brand automobiles and smartphones have lost their presence in the Chinese market, with market shares below 4% and 1%, respectively, classified as "others."

Kim Bongman, head of the FKI International Cooperation Office, stated, "The official and unofficial economic consultative bodies between the two governments should be actively operated to resolve the business difficulties Korean companies face in China, and efforts should be made to promptly conclude the Korea-China Free Trade Agreement (FTA) negotiations on services and investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.