Concerns Over Total Crisis in South Korea's Export-Dependent Manufacturing Industry

China's Semiconductor Self-Reliance Accelerates... US Sanctions on China Overlap

Possibility of Scaling Down or Halting China Operations Even If Immediate Withdrawal Is Unlikely

[Asia Economy Reporter Kim Heung-soon] The declining sales, operating profits, and market shares of major domestic companies with subsidiaries in China can be interpreted as a crisis for South Korea's manufacturing industry, which heavily depends on exports. This indicates that the competitiveness of key items such as semiconductors, automobiles, and electronic devices is gradually weakening in China, considered the world's largest market. With diplomatic and security issues intertwined, including the U.S. sanctions against China, there are even forecasts that related companies may reduce or halt their business operations in China.

Plummeting Semiconductor Exports: Is the Smartphone Crisis Repeating?

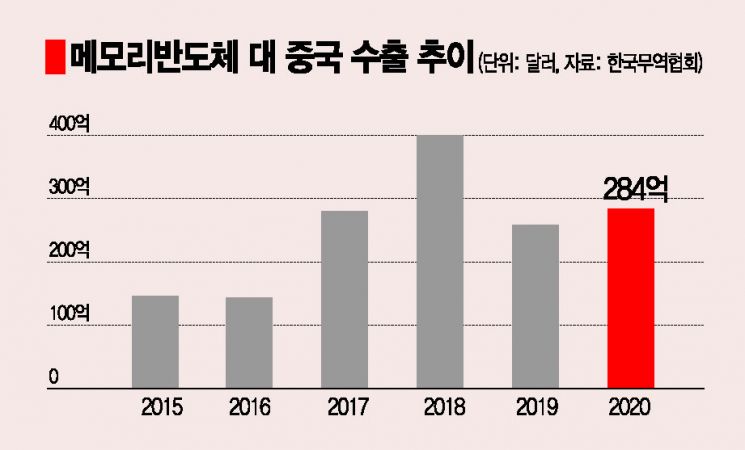

According to the recent five-year performance data of 30 major domestic companies' Chinese subsidiaries released by the Federation of Korean Industries (FKI) on the 6th, the decline in exports in the memory semiconductor sector is particularly notable.

This item recorded export sales of $40 billion (approximately 46 trillion KRW) in 2018, the peak of the semiconductor supercycle (boom period), but dropped by 29.1% to $28.4 billion (approximately 33 trillion KRW) last year. The FKI analyzed that this was due to the reduction in demand for Korean-made memory semiconductors from Chinese companies such as Huawei, caused by the U.S. trade restrictions against China implemented since 2018.

According to the Korea International Trade Association, the proportion of semiconductor exports to China in the domestic semiconductor industry is around 40%, ranking first among major countries. Samsung Electronics and SK Hynix are known to rely on exports to China for about 50% of their annual semiconductor sales. Therefore, these companies maintain production facilities and continue investments and cooperation in Chinese localities such as Xi’an, Wuxi, and Chongqing.

An industry insider said, "As China accelerates semiconductor self-reliance and U.S. trade restrictions against China overlap, demand for Korean products is being affected," adding, "Companies are inevitably in a situation where they must 'tread carefully' to minimize losses between the U.S. and China."

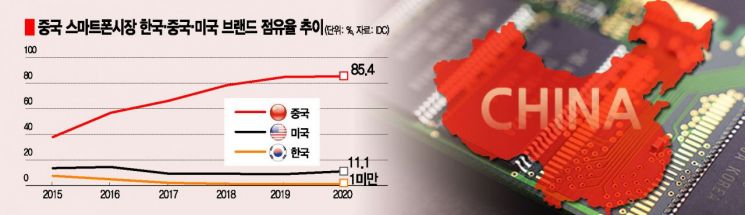

Although not immediate, if the negative impact on performance continues, drastic measures such as business withdrawal may be taken. The smartphone business experienced this. For example, Samsung Electronics struggled against the offensive of Chinese mobile phone companies and competition from overseas manufacturers like Apple, and when its market share in China fell below 1%, it halted production at smartphone factories in Tianjin and Huizhou that had been operating from 2018 to 2019.

Automobile in Crisis... Consolidating Capabilities through Organizational Restructuring

The situation is no different for finished cars. According to the China Association of Automobile Manufacturers, the market share of Korean cars in China fell from 7.7% in 2016 to 4.0%. This contrasts with Japanese brands, which increased their market share from 15.1% to 22.3% during the same period.

According to the automobile industry, as of July, Hyundai’s market share in the Chinese automobile market was 2.1%, Kia’s was 0.8%, totaling 2.9% for the two companies combined. Previously, Hyundai Motor Group’s market share in China reached 10% in 2012.

To revitalize the atmosphere, Hyundai Motor carried out a major organizational restructuring of its Chinese subsidiaries in July. The local subsidiaries responsible for production and sales in China, Beijing Hyundai and Dongfeng Yueda Kia, were placed directly under the CEOs of Hyundai Motor and Kia, respectively, and direct management began. The headquarters will directly manage the Chinese subsidiaries and plans to strengthen sales focusing on eco-friendly luxury cars such as electric vehicles and Genesis in the future.

A Hyundai Motor official said, "Since the organizational restructuring in China in July, personnel adjustments are underway," adding, "We plan to support the China business by consolidating company-wide capabilities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)