[Asia Economy Reporter Lee Seon-ae] The securities industry is re-evaluating Daehan Steel.

According to BNK Investment & Securities on the 5th, Daehan Steel is expected to benefit from the consolidation effect and value reflection of YK Steel going forward. Daehan Steel recently increased its stake in YK Steel from 51% to 70%. Since initially acquiring a 51% stake in September last year, capital has been injected three times this year: in March through a paid-in capital increase and in August through additional stake expansion. With a total investment of 110 billion KRW, Daehan Steel acquired a 70% stake in a company with annual sales of 1 trillion KRW and operating profit (OP) of 80 to 100 billion KRW.

Hyuntae Kim, a researcher at BNK Investment & Securities, raised Daehan Steel’s target stock price to 30,000 KRW on the 3rd, stating, "The timing of the acquisition decision and the process of increasing the stake reveal Daehan Steel’s competitiveness."

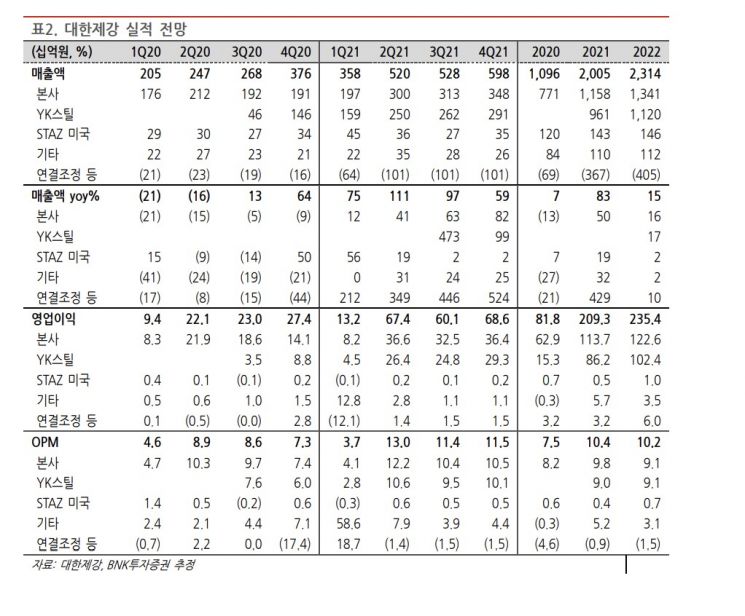

Daehan Steel’s consolidated sales for the second quarter increased by 110.6% year-on-year to 520 billion KRW, and operating profit rose by 205.6% to 67.4 billion KRW, exceeding consensus by 18%. The separate basis operating profit also surpassed expectations, recording 36.6 billion KRW, the highest quarterly profit in 10 years, but the more significant difference was seen in YK Steel’s performance.

Researcher Kim explained, "YK Steel recorded a net profit (NP) of 4.5 billion KRW in the first quarter, but in the second quarter, NP rose threefold to 21.1 billion KRW. Both the headquarters and YK Steel improved performance due to the sharp rise in rebar prices, and since YK Steel has a high proportion of sales to distribution channels, the improvement in second-quarter performance was greater."

The strong demand for rebar continues. In July, actual rebar demand was 989,000 tons, a 22.6% increase compared to the same month last year, which is higher than the 16.8% in the first quarter and 11.3% in the second quarter. He emphasized, "With demand remaining solid mainly in housing construction, and the rebar price system reflecting monthly cost fluctuations, steelmakers’ performance is likely to remain stable. Daehan Steel’s performance is expected to slightly decrease in the third quarter due to fewer business days, but in the fourth quarter, it is anticipated to rise again to nearly 70 billion KRW, setting a new record for maximum profit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.