90% Cleared After About a Year... Only 10% Survive

[Asia Economy Reporter Park Sun-mi] As the one-year grace period for the enforcement of the Online Investment-Linked Finance Business Act (OnTu Act) has ended, only 28 peer-to-peer (P2P) finance companies have been officially registered as OnTu operators. P2P companies that have not applied for registration face a high possibility of closure, so users need to exercise caution.

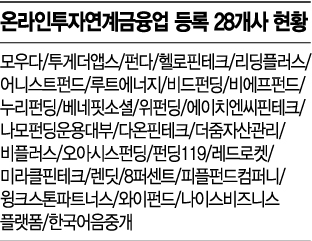

According to financial authorities on the 29th, a total of 28 companies have completed registration as OnTu operators and have joined the formal regulatory system. These include Mowooda, Together Apps, Funda, Hello Fintech, Leading Plus, Honest Fund, Root Energy, Bid Funding, BF Fund, Nuri Funding, Benefit Social, We Funding, HNC Fintech, Namo Funding Operation Loan, Daon Fintech, The Zoom Asset Management, B Plus, Oasis Funding, Funding 119, Red Rocket, Miracle Fintech, Lendit, 8 Percent, People Fund Company, Wink Stone Partners, Y Fund, Nice Business Platform, and Korea Bill Brokerage.

P2P companies were required to register as OnTu operators with approval from the Financial Services Commission according to the OnTu Act, which was enforced on August 27 last year, and the one-year grace period has now ended.

Around 40 P2P companies applied for OnTu registration, but the financial authorities plan to promptly finalize the review results for companies other than the 28 that completed registration, by examining whether they meet the registration requirements. Until registration is completed, these companies must suspend new business operations and can only continue user protection tasks such as recovering and repaying funds for existing investors.

P2P companies that did not even apply for OnTu registration face the possibility of closure. When the financial authorities conducted a full survey of OnTu operators ahead of the OnTu Act enforcement at the end of June last year, there were 237 P2P companies, but about 90% have been cleared out in just over a year.

Due to concerns about consumer damage from P2P company closures, the Financial Services Commission is considering a plan to refinance existing loans of unregistered P2P companies into loans of registered OnTu operators. To protect users, it also plans to dispatch supervisors such as Financial Supervisory Service staff on a permanent basis to companies with large investor bases. Additionally, in case a P2P company closes, it is guiding companies to pre-contract with law firms and debt collection agencies to handle residual tasks and debt collection operations.

Going forward, registration applications and reviews will also be conducted for new businesses wishing to enter the OnTu industry. A Financial Services Commission official said, "With the registration of OnTu operators subject to the OnTu Act, P2P users will be more thoroughly protected, and it is expected to contribute to enhancing the credibility and sound development of the P2P financial industry in the future." The official also urged, "Users should be aware that principal guarantees are not possible due to the nature of P2P loans, and should be especially cautious of companies engaging in loss compensation practices or offering excessive rewards."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.