Increasing Credit Limits and Actively Launching New Products

Aggressive Sales Practices Defying Market Trends

[Asia Economy Reporter Jin-ho Kim] While the financial authorities' pressure has led to a 'loan reduction' phenomenon across the entire financial sector, only the first internet bank, K-Bank, is accelerating its business expansion, drawing attention. Unlike most banks that have reduced limits and stopped sales, K-Bank is taking aggressive actions such as significantly raising limits and launching new products.

According to the financial sector on the 27th, K-Bank will launch two new products, Jeonse loans and Youth Jeonse loans, at the end of this month. These products are characterized by allowing customers to check the expected interest rate and limit immediately by entering simple information. Leveraging the advantages of an internet bank, all processes are provided 100% non-face-to-face. The Jeonse loan limit is 220 million KRW, and the Youth Jeonse loan limit is 100 million KRW. The loan interest rate is as low as 1.98% per annum (as of the 26th).

Since launching apartment mortgage loans last year, K-Bank has diversified its loan portfolio by consecutively launching Saetdol loans and Jeonse loans this year. K-Bank's strategy is to actively supply loans to low- and medium-credit borrowers through this approach.

The new unsecured loans with low interest rates and high limits are also more competitive compared to commercial banks. Currently, most commercial banks have reduced unsecured loan limits to 50 million KRW, but K-Bank's limit is up to 250 million KRW, which is five times higher. The overdraft limit is also around 150 million KRW.

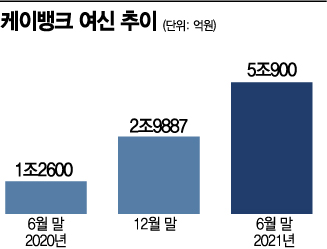

The reason K-Bank can actively expand its business against the market trend is that it is located in a blind spot of the financial authorities' total volume regulation. The total volume regulation is managed based on the growth rate compared to the end of the previous year, but K-Bank has effectively started its loan business only this year. As of the end of June, K-Bank's loan balance was about 5.05 trillion KRW. Although it shows rapid growth compared to the end of last year (2.9887 trillion KRW), it still remains the smallest among major banks in scale.

Therefore, K-Bank seems to view the current 'loan crisis' situation as an opportunity. Conditions have been created to significantly boost the previously slow growth through high limits and new products. A financial sector official said, "Since K-Bank is still in the early stage of growth and much smaller in scale, the financial authorities will inevitably offer some convenience. It clearly appears to be an opportunity to close the gap with KakaoBank and others that has developed so far."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.