Regular Payments Issued One Month Ahead of Legal Deadline... 5 Trillion Won to a Total of 4.87 Million Households

[Sejong=Asia Economy Reporter Kim Hyunjung] An average of 1.14 million KRW in Earned Income Tax Credit (EITC) and Child Tax Credit was paid to low-income households. For multi-child households, the amount reached up to 9 million KRW, with a total scale of 4.87 million households and approximately 5 trillion KRW.

On the 26th, the National Tax Service announced that it paid the 2020 earned income and child tax credits more than a month earlier than the legal deadline of September 30 to support low-income households struggling due to COVID-19. The EITC and Child Tax Credit are programs designed to encourage work motivation and support child-rearing for low-income households. The 2020 regular application and semi-annual settlement earned income and child tax credits paid on this day amounted to 406.6 billion KRW for 4.68 million households. Including the first and second half payments made in December last year and June this year, the total credits for 2020 income amounted to 4.9845 trillion KRW for 4.87 million households. This is 12.1 billion KRW more than the 4.9724 trillion KRW paid for 2019 income.

The average amount of earned income and child tax credits per household for 2020 income was 1.14 million KRW, with the earned income credit averaging 1.05 million KRW and the child tax credit 860,000 KRW. Households with many children received credits up to the 9 million KRW range. A single-earner couple in their 50s living in Seoul, supporting 11 minor children with an annual earned income of 4.86 million KRW, received a total of 9.52 million KRW in credits, including 1.82 million KRW in earned income credit and 7.7 million KRW in child tax credit. This is the highest amount among the 2020 income credits. A dual-earner couple in their 40s living in Pyeongtaek, supporting 9 minor children with an annual earned income of 18 million KRW, received a total of 9.16 million KRW in credits, including 2.86 million KRW in earned income credit and 6.3 million KRW in child tax credit.

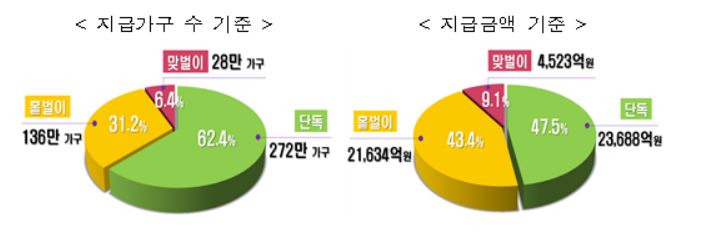

By household type for 2020 income credits, single-person households accounted for the largest share at 62.4% (2.72 million households), followed by single-earner households at 31.2% (1.36 million households), and dual-earner households at 6.4% (280,000 households). In terms of payment amounts, single-person households received the largest share at 47.5% (2.3688 trillion KRW), followed by single-earner households at 43.4% (2.1634 trillion KRW), and dual-earner households at 9.1% (452.3 billion KRW).

By income type, earned income households were the majority at 60.1% (2.62 million households), followed by business income households at 39.4% (1.72 million households). Among earned income households, daily workers accounted for 54.6% (1.43 million households) and regular workers 45.4% (1.19 million households). Among business income households, 67.4% (1.16 million households) were self-employed workers such as special employment types, and 32.6% (560,000 households) were business operators.

The credits were deposited on this day into pre-registered bank accounts. For those who did not register an account, cash can be received by visiting a post office with the National Tax Refund Notice and identification. If you met the application requirements for last year's income credits but missed the application deadline, you can apply by November 30 using Hometax or Sontax services.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)