Announcement on 'Assessment of COVID-19 Impact on Small Business Owners and Additional Support Measures'

[Sejong=Asia Economy Reporter Son Sun-hee] On the 26th, the government announced that it will further extend the payment deadlines for value-added tax and comprehensive income tax for small business owners and others, and will also postpone or apply exceptions to various social insurance premiums and utility bills. This additional support measure was introduced by the government to help small business owners pushed to the brink of survival due to the implementation of high-intensity quarantine measures amid the fourth wave of COVID-19.

On the 26th, Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, chaired the Emergency Economic Central Countermeasures Headquarters meeting at the Government Seoul Office and announced the "Small Business Owners COVID-19 Impact Review and Additional Support Plan," which includes these measures.

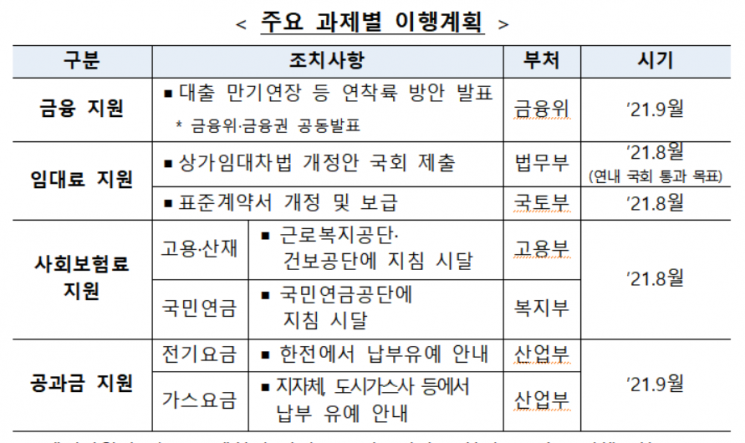

For workplaces with fewer than 30 regular employees, an additional three-month deferral of payment for employment and industrial accident insurance premiums for the fourth quarter (October to December) will be implemented. In the case of industrial accident insurance premiums, one-person self-employed and special-type workers (teukgo) workplaces are also included in the deferral targets.

Additionally, National Pension subscribers whose income has decreased will be exempt from paying the National Pension premiums for the fourth quarter. Utility bills such as electricity and city gas will also have their payments postponed. Small business owners will be allowed a three-month deferral for the fourth quarter’s electricity and city gas bills, and installment payments over six months will be permitted.

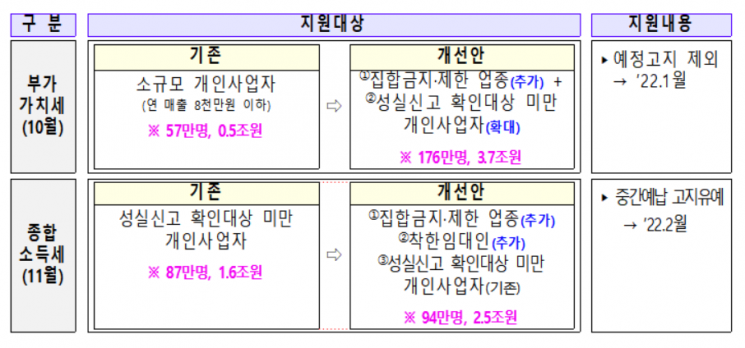

Tax support and its targets will also be expanded. The government decided to extend the payment deadlines for value-added tax (October) and comprehensive income tax (November) by three months each. Furthermore, the support targets, which were previously limited to small individual business owners with annual sales under 80 million KRW (for VAT) and individual business owners below the threshold for diligent reporting verification (for comprehensive income tax), will be expanded to include all businesses subject to 'closure or restriction' orders. The deferral of comprehensive income tax payments will also include benevolent landlords.

Accordingly, it is estimated that approximately 1.76 million people will benefit from a total of 3.7 trillion KRW in VAT payment deferrals, and about 940,000 people will receive benefits totaling 2.5 trillion KRW for comprehensive income tax.

Along with this, to improve liquidity for small business owners, the government will advance the payment of VAT refunds (such as for facility investments), originally scheduled for October 12, to the end of next month. Also, in cases where unavoidable tax arrears occur, to encourage early business normalization, property seizure and sale measures will be deferred for up to one year.

Since the COVID-19 outbreak in January last year has continued for over a year and a half, damage to small business owners mainly engaged in face-to-face service industries has accumulated. During this period, as closures surged, conflicts over lease contracts were frequent on the ground.

In response, the government is promoting a "Standard Contract Amendment" that grants the right to terminate contracts to tenants who have closed their businesses after being subject to closure or restriction orders for more than three months due to COVID-19. The revised provisions are expected to be reflected in the Ministry of Land, Infrastructure and Transport’s real estate electronic contract system within this month. A related amendment to the Commercial Lease Protection Act was submitted to the National Assembly on the 19th.

To help closed self-employed business owners successfully restart, support for reemployment in promising fields will also be provided. A package including business closure consulting, demolition cost support, and legal advice will be offered at the closure stage, and costs related to business conversion and reestablishment will be expanded.

The government plans to implement these additional support measures for small business owners immediately within this month, and financial support measures such as loan maturity extensions will be announced next month. The government stated, "We will provide full support in cooperation with related ministries to ensure that the business environment for small business owners quickly recovers to pre-COVID-19 levels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.