1.075 Trillion Won Capital Inflow Over 3 Months

Returns Exceed 20% Since the Beginning of the Year

[Asia Economy Reporter Song Hwajeong] As the U.S. stock market continues to hit record highs day after day and shows strength, funds are pouring into North America funds.

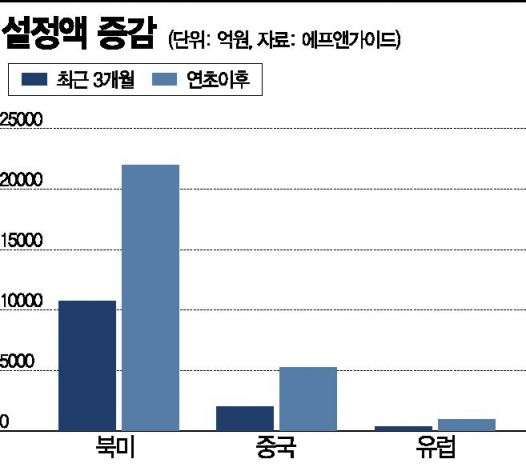

According to financial information company FnGuide on the 25th, North America funds have seen an inflow of 1.075 trillion KRW over the past three months. Since the beginning of the year, 2.1962 trillion KRW has flowed in steadily. The number of North America funds with assets over 1 billion KRW increased from 55 to 64 compared to a year ago, and net assets grew about threefold from 2.7952 trillion KRW to 8.5602 trillion KRW.

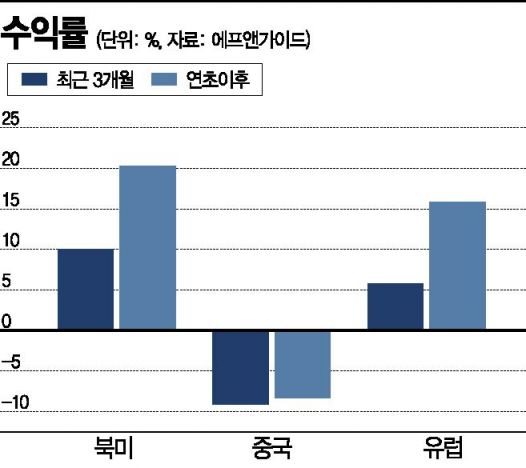

The returns are also favorable. North America funds recorded a 10.02% return over the past three months. Since the beginning of the year, they have risen more than 20%. This significantly outperforms the KOSPI's recent three-month return of 0.44% and year-to-date return of 9.87%.

The reason for such capital inflows into North America funds is the U.S. stock market, which continues its upward trend by hitting record highs day after day. On the 24th (local time), the Dow Jones Industrial Average rose 30.55 points (0.09%) to close at 35,366.26, the S&P 500 increased 6.70 points (0.15%) to 4,486.23, and the Nasdaq rose 77.15 points (0.52%) to 15,019.80. The Nasdaq surpassed the 15,000 mark for the first time ever on a closing basis, and the S&P 500 set its 50th record high of the year. The Nasdaq has risen 16.54% this year, the S&P 500 by 19.44%, and the Dow Jones by 15.55%, respectively.

Han Jiyoung, a researcher at Kiwoom Securities, said, "The U.S. stock market closed higher yesterday, supported by weak July housing data, ongoing expectations for delayed tapering despite the Jackson Hole meeting on the 27th, and the easing impact of the Delta variant due to expanded vaccination." She added, "Until early August, weak economic indicators were seen as negative factors in the market, but now these weak indicators are perceived as positive factors that will make the U.S. Federal Reserve (Fed) more patient."

Attention is focused on the U.S. stock market's movement after the Jackson Hole meeting. Kim Jungwon, head of investment strategy at Hyundai Motor Securities, explained, "At the Jackson Hole meeting, Chairman Powell is expected to be more cautious about changes in monetary policy." He added, "Due to the impact of the Delta variant, the start of tapering is more likely to be delayed from the September Federal Open Market Committee (FOMC) meeting to as late as December or early next year." He further noted, "Despite concerns about economic slowdown, the highlighted uncertainties related to tightening could ease quickly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.