PMI at 55.4 in August, Below Forecast

Interpreted as Reduced Consumer Spending and Limited Sales Expansion

Focus Ahead of This Week's Jackson Hole Meeting

"Asset Purchases and Rate Hike Pace Likely to Slow"

Dollar Shows Sharp Decline

[Asia Economy New York=Correspondent Baek Jong-min] As the slowdown in the U.S. economy due to the spread of the COVID-19 Delta variant is confirmed by indicators, expectations are growing that the Federal Reserve's (Fed) tapering (asset purchase reduction) measures may be delayed. While attention is focused on what Fed Chair Jerome Powell will say about tapering at this weekend's Jackson Hole meeting, the U.S. dollar showed a sharp decline.

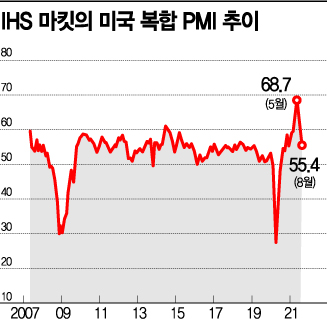

On the 23rd (local time), the Purchasing Managers' Index (PMI) for August released by research firm IHS Markit suggested that U.S. business activity slowed for the third consecutive month amid the spread of the Delta variant.

IHS Markit's August manufacturing PMI stood at 61.2, and the services PMI was 55.2. The composite PMI was 55.4. All figures fell short of market expectations. In particular, the services PMI was significantly below the expected 59.5. This confirmed a decline in the service sector, which accounts for two-thirds of the U.S. economy. A PMI above 50 indicates expansion, while below 50 indicates contraction.

Chris Williamson, an economist at IHS Markit, explained that the U.S. economic expansion sharply slowed in August, saying, "As the Delta variant spreads, consumers are reducing spending on services, and companies' efforts to expand sales are also limited." The Wall Street Journal expressed concern, stating, "The biggest change is happening in the U.S. economy, which has led the global economic recovery since the COVID-19 crisis."

As the possibility of economic slowdown became more apparent, the dollar index fell by 0.5% to 93.013 that day. The dollar index had recently strengthened on expectations of Fed tapering.

After the July Federal Open Market Committee (FOMC) meeting minutes were released last week, revealing that most Fed officials considered tapering appropriate within the year, the situation where tapering within the year was taken for granted is now showing signs of change.

The market had placed weight on the possibility of tapering within the year after the FOMC minutes were released. David Mericle, chief economist at Goldman Sachs, predicted after the FOMC minutes release that "the Fed will signal asset purchase reduction in September, officially announce tapering in November, begin implementation in December, and end asset purchases by September next year."

In this situation, concerns about the economic recovery slowdown were raised within the Fed. The trigger was Robert Kaplan, president of the Dallas Federal Reserve Bank and a 'hawk' advocating early tapering. On the 20th, Kaplan surprised the market by mentioning that if the Delta variant harms the economy, early implementation of tapering could be reconsidered.

Edward Moya, chief economist at foreign exchange investment firm OANDA, forecasted, "There will be a tapering announcement within this year, but the pace of asset purchase reduction will be very slow, and a rate hike by the end of next year also seems difficult."

Expectations regarding tapering are likely to emerge at this weekend's Jackson Hole meeting. Powell's speech is scheduled for 10 a.m. on the 27th.

The Wall Street Journal predicted that Powell will clarify the Fed's policy direction amid internal divisions over future monetary policy and sluggish economic recovery due to the spread of the Delta variant at this Jackson Hole meeting. On the other hand, Michael Darda, chief economist at MKM Partners, said in an interview with Bloomberg TV, "Powell will try not to cause a big stir."

The Jackson Hole meeting itself was not spared from the impact of the Delta variant spread. The Federal Reserve Bank of Kansas City, which hosts the Jackson Hole meeting, announced last week that this year's meeting will be held virtually. This reversed the earlier announcement in May that the Jackson Hole meeting would be held in person.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)