Top 5 Banks and Internet Banks, Average Interest Rate Up to 3.79%

0.7 Percentage Point Increase in One Year

Expected to Rise to 4% Range with Base Rate Hike

[Asia Economy Reporter Kim Jin-ho] Jeong Jun-ho (34, pseudonym), an office worker at a leading domestic conglomerate, was recently shocked when he extended the maturity of his credit limit loan (overdraft) at a major commercial bank. The loan interest rate, which was in the mid-2% range last year, jumped to the high 3% range. Jeong said, "I got promoted this year and my credit score improved, but on the contrary, the loan interest rate rose too much, increasing my burden," adding, "I personally felt that the interest rate hike is becoming full-scale."

The interest rates on overdraft loans, which office workers commonly use as emergency funds, are rising rapidly. Just a few months ago, the common 2% range interest rates have now disappeared. With the base interest rate expected to rise soon and financial authorities set to tighten household loan regulations, the pace of loan interest rate increases is expected to accelerate further.

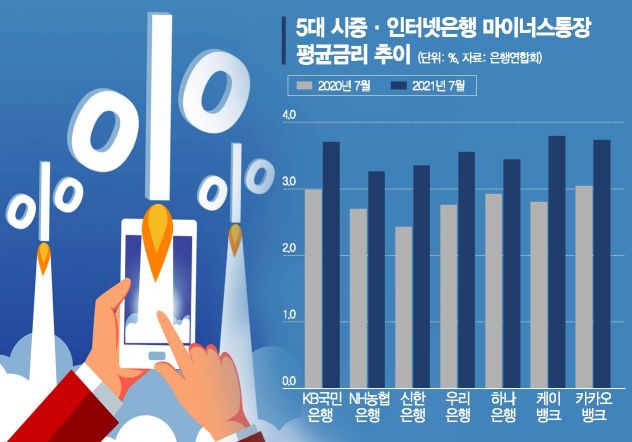

According to the Bankers Association on the 24th, the average overdraft interest rates handled last month by the five major commercial banks?KB Kookmin, Shinhan, Woori, Hana, NH Nonghyup?and internet-only banks such as K Bank and Kakao Bank ranged from 3.26% to 3.79% annually. This is a 0.7 percentage point increase compared to a year ago (2.43% to 3.04%).

Looking at last month's average overdraft interest rates, K Bank had the highest at 3.79%. Kakao Bank (3.73%), KB Kookmin Bank (3.70%), Woori Bank (3.55%), Hana Bank (3.44%), and Shinhan Bank (3.35%) followed. The 2% range overdraft loans have disappeared across both the five major commercial banks and internet banks.

Compared to a year ago, the speed of loan interest rate increases is easier to feel. In July last year, among seven commercial banks, only Kakao Bank recorded an overdraft interest rate in the 3% range. Shinhan Bank had the lowest at 2.43%, while Nonghyup Bank (2.70%), Woori Bank (2.76%), and K Bank (2.80%) all recorded mid-to-high 2% range rates.

Notably, the two internet banks showed a larger increase in interest rates compared to other commercial banks. Kakao Bank's rate rose by 0.69 percentage points, and K Bank's by 0.99 percentage points. This is analyzed to be due to reducing loans to high-credit borrowers and increasing loans to medium- and low-credit borrowers.

The rapid rise in loan interest rates within just one year is because banks raised their own calculated spread rates, which serve as the basis for loan interest rate calculation, by a larger margin than the base interest rate. The financial bond and 3-month KORIBOR rates, which are the standards for calculating credit loan interest rates, only increased by 0.07 percentage points over the past year, but the interest rate hikes applied to consumers reached about ten times that.

The reason for the larger increase in spread rates is that financial authorities recommended curbing the growth rate of household loans and reducing preferential interest rate benefits related to credit loans concentrated on high-credit borrowers. From the banks' perspective, there are only two ways to suppress household loans as desired by financial authorities: reducing loan limits or raising interest rates.

However, financial consumers are voicing complaints about the sharp rise in loan interest rates. Even borrowers like Jeong, who got promoted, received a salary increase, and improved their credit scores, could not avoid steep loan interest rate hikes. For borrowers with lower credit scores, the interest rate increase is known to reach up to 1 to 2 percentage points.

The problem is that if the Bank of Korea raises the base interest rate soon, loan interest rates could rise further. If the base rate increases, the current overdraft loan interest rates in the mid-to-high 3% range are expected to jump to the 4% range. Additionally, with financial authorities indicating plans to tighten loan regulations further in the second half of this year, banks are expected to reduce preferential interest rates more, making the loan interest rate increase felt by consumers even steeper.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.