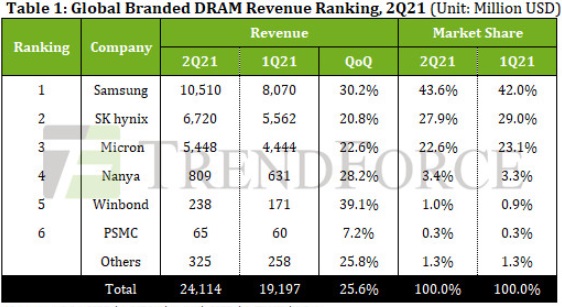

[Asia Economy Reporter Suyeon Woo] In the second quarter of this year, global DRAM market sales surged 26% quarter-on-quarter, driven by robust demand. Sales of Korean DRAM companies such as Samsung Electronics and SK Hynix also improved significantly, capturing a 71.5% market share.

According to TrendForce on the 24th, global DRAM market sales in the second quarter reached $24.114 billion, marking a 26% increase compared to the previous quarter. This is a remarkable growth compared to the 8.7% increase recorded in the first quarter. Both DRAM prices and shipment volumes rose in the second quarter, greatly improving the performance of DRAM suppliers.

The spread of online education trends not only sustained strong demand for laptops but also boosted demand for Chip Scale Package (CSP) chips, mainly used in smartphones, which contributed to the expansion of DRAM inventory. At the same time, graphics DRAM and consumer DRAM also performed well by targeting niche markets.

Thanks to the favorable DRAM market in the second quarter, domestic DRAM companies such as Samsung Electronics and SK Hynix saw their sales increase by around 30%. However, their global market share remained largely unchanged at 71.5%, up only 0.5 percentage points quarter-on-quarter.

In particular, Samsung Electronics’ DRAM division sales in the second quarter reached $10.51 billion, a remarkable 30% increase from the previous quarter. This is estimated to be due to a significant increase in production volume by improving the process yield of the 10nm-class 3rd generation (1z) products. As a result, Samsung’s DRAM division operating profit margin rose from 34% in the first quarter to 46% in the second quarter. Considering the steady DRAM demand and rising prices, TrendForce forecasts that the margin will exceed 50% in the third quarter.

SK Hynix also recorded over 20% sales growth due to the market boom and process yield improvements. SK Hynix’s second-quarter sales were $6.72 billion, up 20.8% quarter-on-quarter, and its operating profit margin rose to 38% in the second quarter.

Meanwhile, although the global DRAM market boom is expected to continue into the third quarter, the sales growth rate is anticipated to slow compared to the second quarter. TrendForce predicts that the fixed transaction price for PC DRAM in the third quarter will rise 3-8% quarter-on-quarter, a slowdown compared to the 23-28% increase seen in the second quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)