Decline in Won Value Makes Losses Inevitable

Export Manufacturing Faces Demand Slowdown Concerns

[Asia Economy Reporters Hwang Yoon-joo and Lee Dong-woo] Following the spread of the COVID-19 Delta variant, the won-dollar exchange rate surged to its highest level in 11 months, leaving industries in a dilemma. The refining and aviation sectors, which settle payments for crude oil and fuel costs in dollars, are inevitably facing losses due to the rising exchange rate (decline in the won's value). Export companies such as automobile and home appliance manufacturers, which typically benefit from a rising exchange rate through improved price competitiveness, are not entirely welcoming the recent trend, as it is driven by concerns over the U.S.'s early tapering (reduction of asset purchases).

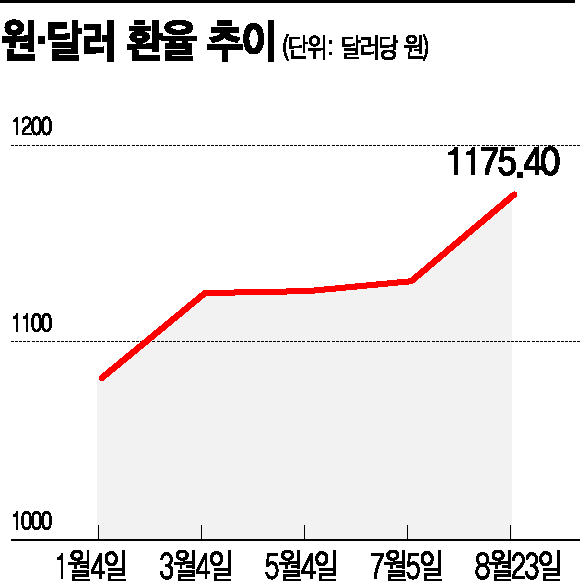

On the 23rd, in the foreign exchange market, the won-dollar exchange rate was 1,183.50 won as of the 20th, marking an 8.6% increase compared to the beginning of the year (1,082.50 won on January 4). As of 10:20 a.m. that day, the won-dollar exchange rate stood at 1,173.60 won, down 9.9 won from the previous trading day, but there are forecasts that it could approach the 1,200 won level.

The aviation industry is currently suffering immediate losses due to the sharp decline in the won's value. Since aviation fuel and aircraft lease fees are calculated in dollars, an increase in the exchange rate results in larger foreign currency translation losses. As of the end of June this year, Korean Air incurs approximately 56 billion won in foreign currency valuation losses for every 10 won increase in the exchange rate, while Asiana Airlines faces losses of 34.3 billion won.

The refining industry is also closely monitoring the situation. More than 50% of the cost of sales in the refining sector is the cost of crude oil purchases. Since crude oil payments are made in dollars, a sharp rise in the exchange rate inevitably leads to losses. Although this does not directly affect operating profit, it causes net losses. In fact, SK Innovation reported that a 5% increase in the exchange rate in the first half of this year reduced its pre-tax net income by 54.1 billion won.

S-OIL experienced a foreign exchange loss of 94.9 billion won based on pre-tax profit in the first half of this year. A refining industry official stated, "Although it is known that a rising exchange rate is advantageous for petroleum product exports, the negative impact from crude oil purchases is greater," adding, "To minimize risks, crude oil purchases are hedged against exchange rate fluctuations, and this is why refiners are expanding petrochemical product production."

On the other hand, export manufacturing industries such as electronics and automobiles see improved profitability when the exchange rate rises. According to the Korea International Trade Association, in the electronics sector, a 10% increase in the exchange rate leads to a 4.7% increase in sales and only a 2.1% rise in cost of sales, resulting in a 2.5% increase in operating profit margin.

Due to the exchange rate increase in the first half of this year, Samsung Electronics reported that its operating profit in the second quarter increased by approximately 200 billion won compared to the previous quarter. Hyundai Motor Company stated in its semi-annual report that a 5% rise in the exchange rate would increase its pre-tax net income by about 110.8 billion won. However, since the recent won-dollar exchange rate movements are related to discussions on U.S. tapering, there is concern that this could spread to a slowdown in global demand in the future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)